5 Tested Money Saving Grocery Shopping Tips You'll Love!

Are you looking to save money grocery shopping? Apply these five tested savings tips the next time you shop!

Your grocery bills quickly add up.

Inflation is not going away.

Prices only become more expensive on each of my grocery store visits.

You don't need to spend a fortune to eat well.

I enjoy grocery shopping. I like to cook. I want to find the best sales and comparison shop at grocery stores. Grocery shopping and learning to cook are more cost-effective. Cooking helps me watch my portion sizes and eat healthier than going out to eat.

I use these strategies to save money when grocery shopping.

You’ll love these five money saving tips during your next grocery store visit!

🚨Problem: Shopping Without A List Leads To Overspending

You enter the grocery store without a strategy.

Going to a store without a plan is horrible.

Why?

You don't know what to buy.

You'll end up purchasing items you want versus what you need.

✅Solution: Make A Detailed Grocery List

Creating and following a grocery list before you enter the grocery store reduces impulse purchases. A grocery list helps you save money.

Check your pantry, cabinets, refrigerator, and freezer for what you already have at home before grocery shopping.

Plan your meals for the week. Meal planning helps you buy only the food you'll eat during the week.

Organize your list by sections. Shop the produce, dairy, canned goods, meat, pastry section, and personal health section. Dividing your list into the store's sections prevents you from backtracking in the store. An organized list is another financial strategy to stop you from making impulse purchases.

Use a shopping app like AnyList or Shopping List. Making and following a list keeps you accountable for purchasing only the necessary items.

I use the Shopping List app on my Android phone for every grocery store visit. A shopping list saves me time and money when planning my weekly meals.

A shopping list and meal plan will do the same for you.

😎Why Does This Matter?

A grocery list keeps you on track.

A list prevents you from making impulse purchases.

Save the extra money and put it into a high-yielding money market account!

🚨Problem: Impulse Purchases Wreck Your Budget

I worked a part-time job scanning the barcodes on the back of products in grocery stores on the end caps.

The companies want grocery stores to market products on the end caps every week.

These displays, end caps, free samples, and sales get you to buy extra items while shopping.

✅Solution: Train Yourself To Resist Temptation

Practice self-discipline when you're grocery shopping.

Stick to the store's perimeter. Fresh food, from produce to meat, is on the perimeter of a store. Avoid the junk food, canned goods, and snacks in the middle aisles.

Follow the ten-second rule. The ten-second rule states that before you grab an unplanned item, pause and ask: "Do I really need this?" Place the product back on the shelf if you answer no.

Order online and pick up. No more wandering the aisles means fewer impulse purchases. The downside to ordering online is that you can't pick out the best produce or meat cuts.

😎Why Does This Matter?

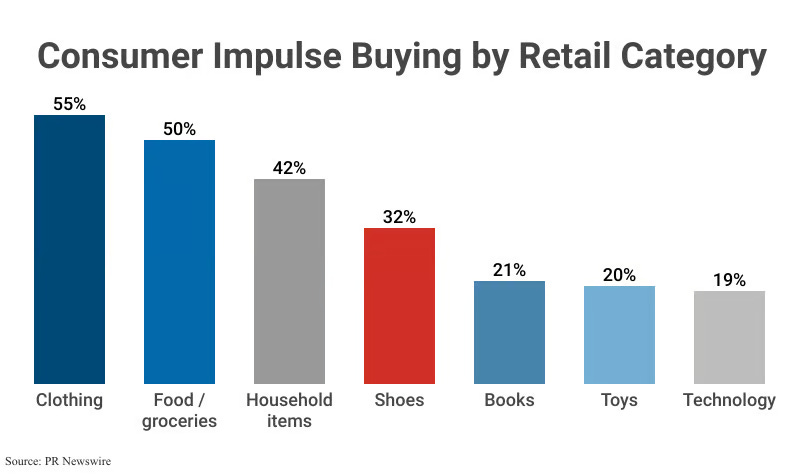

According to CapitalOne Shopping:

A consumer makes "six (6) impulses purchases per month."

"54% of shoppers have spent $100 or more on an impulse buy."

"The average consumer spends $281.75 per month on impulse buys in 2024 for a projected total of $3,381."

You could invest that $3,381 into the stock market to build wealth!

🚨Problem: Shopping Hungry Makes You Buy Junk Food

I usually grab food from the store's deli when I shop hungry. My favorites are traditional and boneless buffalo wings. Buffalo wings sound great at the time, but they're unhealthy.

Your weakness may be another type of junk or comfort food. You then load up your cart with extra snack items that you don't need. You didn't plan to buy.

Before you know it, you have a large grocery bill when you leave the grocery store.

✅Solution: Never Grocery Shop On An Empty Stomach

Save money by never entering a grocery store when you're hungry.

Eat a protein-rich snack before you go grocery shopping. Protein-rich foods include nuts, yogurt, or a protein bar.

Drink water so you do not feel hungry in the store. You may buy an extra drink that you did not plan to buy. You may mistake your thirst for hunger.

If you're hungry when you enter the store and cannot eat a snack, grab a small cart instead of a big cart. A small cart means less space to purchase extra items.

😎Why Does This Matter?

Research has found that hungry shoppers spend 64% more on high-calorie, low-nutrient foods.

Eating a quick snack before you go to the grocery store could save you 20% per trip!

You could invest that extra money in index funds in your retirement account.

🚨Problem: Name Brands Cost More Than Store Brands

You're paying a premium when you purchase name brands like Heinz, Kraft, Coca-Cola, Doritos, and Hershey's.

The store's generic brand is often as good as the name brand. Sometimes, the store brand is better!

Try the store brand. You may like it. You'll be saving money, too!

✅Solution: Make The Switch To Store Brands

You can buy the store brands of everyday items that you regularly buy.

Start with purchasing the basics. Your daily essentials are milk, eggs, pasta, and canned or frozen veggies.

Compare the ingredients list. Generic store brands often make their products in the same factories as name brand products. You're paying extra for the name, logo, and fancy packaging.

Try one new generic store brand per trip to the grocery store. Keep track of the store brand products that you like.

😎Why Does This Matter?

According to Consumer Affairs, store brands cost 15% to 30% less than name brands.

That adds up quick if you spend $100 a week on groceries.

$30x4x12=$1,440 a year in savings

You could use that savings to start an online business.

🚨Problem: Not Checking Unit Prices Means You're Overpaying For Products

A big box of cereal seems like a better deal.

But sometimes, the smaller box is cheaper per ounce.

Check the unit price to compare which product costs less when you're in the grocery store.

✅Solution: Always Look At The Price Per Unit

Keep an eye out for the price tag for the products below that list the unit price. The unit price is another strategy to save money at the grocery store.

Find the price per ounce or pound on the store's shelf tag.

Compare sizes to the cost per unit. Sometimes, it's more cost-effective to buy two smaller items instead of one big one.

Use a calculator if you need to. Divide the total price by ounces to double-check to find the cheaper product.

😎Why Does This Matter?

Picking the product with the lowest unit price saves you money.

That's extra savings in your bank account.

Direct that money you save toward dividend-paying stocks to build a passive income stream!

🏁Summary

You don’t have to use all of these five money saving tips at once.

Start with using one.

You'll watch your weekly grocery bill shrink.

Over time, these savings add up to thousands per year.

You can use that money to pay off debt, save, invest, or start a business!

Here is a quick recap of the five ways to save money during a grocery trip:

✅ Plan meals and make a list.

✅ Avoid impulse buys.

✅ Never shop hungry.

✅ Switch to store brands.

✅ Check unit prices.

Which strategy will you use on your next visit to the grocery store? Let me know in the comments below!

Disclaimer: This content is for educational, entertainment, and informational purposes only. This is not financial or investment advice. I'm someone who writes online about topics I find interesting. I make mistakes just like everyone else. Always consult a professional before making health, life, financial, investment, tax, or legal decisions.