5 Tested Ways How Taking Action During Market Downturns Make You Rich

Take action and be greedy when markets are down. Buy when people sell from fear.

One of the lessons I learned from my copywriting certification course is that there are six basic human emotions. Another part of the copywriting course was understanding how human emotions and psychology influence consumer behavior. Fear and greed are two of the most powerful that drive human behavior.

Fear and greed play a major role in the financial market.

People withdraw money from their market positions out of fear, hearing bad financial news, a company receiving bad press, or losing money in the stock market.

The best investment opportunities are when the market tanks and everyone runs away.

These are five tested ways how taking action during market downturns make your rich.

🚨Problem: You Make Poor Decisions When You're Fearful

You make bad life decisions when you're irrational.

Never make life-changing decisions when you're depressed, anxious, or fearful.

The same principle applies to investing.

You'll regret it later.

I almost shut down my business when I was depressed. Everyone I knew told me to close it and to work at Costco. I'm happy I didn’t listen to them. I would have regretted my decision.

🆘Investors Panic And Sell Low

The financial news headlines warn you that the stock market is entering a bear market, is crashing, the next world war is about to start, a natural disaster is in the news, or an economic disaster is imminent.

Most people immediately sell their stocks to cut their losses.

Mass selling of stocks drives the prices down in the stock market.

It's the basic economic law of supply and demand in action.

🆘You Miss Out On Future Gains

Fear makes you sell while the market is crashing.

You pull out of your investments for fear of losing money.

You sit on the sidelines and cash out of fear.

Companies are on sale in the stock market!

You will later enter the stock market once it goes back up. Prices recover.

You miss buying when prices are low.

You miss the fire sale.

You want to buy assets when they are cheap rather than expensive.

Why?

You'll make more profit.

🆘You Follow The Crowd, Not Logic

You make the mistake of following the crowd.

Herd mentality is irrational.

Herd mentality is dangerous.

Herd mentality is costly.

You sell because that's what everyone is doing in the stock market.

You're losing money by following the crowd.

It's easy to follow the crowd, but you're losing money in this case.

Herd mentality costs you because you buy high and sell low.

You lose money.

That's the exact opposite of smart investing!

Investing in appreciating assets aims to make money and grow your wealth.

Related - 6 Sure-Fire Reasons Why Going Your Own Way Leads To Epic Success

✅Solution: Buy Assets When Others Are Fearful

The general trend has been up over the decades for the stock market.

Purchasing assets when others sell out of fear is the best time to build wealth.

👌Lower Prices = Better Deals

Do you prefer to shop at full price or get black friday sales?

You want to buy products when they're on sale.

The same is true for the stock market.

When stocks drop 20%, 30%, or even 50%, strong companies become cheap!

You can now buy more shares in a company.

You'll receive more dividends.

You'll own more company shares when the stock market increases again for capital appreciation.

👌The Market Always Recovers

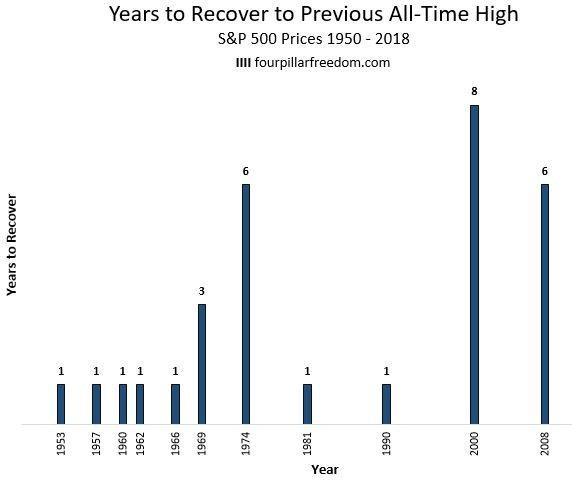

Stock market history proves that a recovery always follows every major crash in the stock market.

The S&P 500 never stays down permanently.

Be patient. Wait for the stock market to recover.

Continue investing in the market.

👌Key Stock Market Recovery Stats

The Dot Com crash took eight years for the stock market to fully recover.

The stock market took about six years to fully recover after the 2008 Financial Crisis.

The market rewarded long-term investors who bought and held during the crash for staying invested in the stock market.

👌Strong Companies Will Survive And Thrive

Market cycles are natural.

Market cycles are healthy.

Market booms are when too many businesses start.

Good and bad quality businesses are founded during the boom cycle.

People start the latest business ideas and follow hot investment trends.

The poorly run businesses and investments start to go under during the boom.

The market bust cleans out the malinvestment from failed businesses and investments.

The market bust results in a recession or depression. A financial downturn is necessary to resolve the malinvestments throughout the economy.

The market cycle will continue all over again in the following decade.

✔️Market Cycles And Investing

Strong, established businesses don't disappear during recessions and market downturns.

These businesses are already reliable household names.

Established businesses have strong balance sheets that generate revenue and profit.

When prices go down for these businesses in the stock market, it's a buying opportunity for investors.

☑️What To Look For:

Find companies with low debt and strong cash flow.

Look for businesses that provide essential products and services that people always need.

Seek out the industry leaders with competitive advantages and large moats.

😎Why Does This Matter?

Understand how market and business cycles work to buy companies toward the market bottom instead of the top.

Building wealth over time is easier by purchasing when stocks are cheap.

Be greedy when prices are low instead of fearful.

Source: Radical Discourse. (2010, January 24). Fear the Boom and Bust: Keynes vs. Hayek - The Original Economics Rap Battle![Video]. YouTube.

Keynes versus Hayek on the cause of the boom and bust cycle. Keynes wants to “steer markets,” while Hayek wants " them [markets] set free.”

📈You Lock In Higher Future Returns

Buy at low prices.

Your investments will give you a higher return on your investment.

📈It's Simple Math

If you buy a stock at $50 and it recovers to $100, you get a 100% return on your investment.

If you wait for the market to correct and buy the same company at $80, you only make 25%.

📈You Avoid The Trap Of Attempting To Time The Market

No one knows the exact market bottom.

It's foolish to wait to buy shares in companies you want to own.

You may miss the market's downturn.

You'll then pay what you would have paid before the downtrend because you were afraid to buy.

Buying during fear means you're purchasing shares at a discount.

Don't be late and miss the stock market sale to own more shares or new financial assets.

📈Develop A Winning Mindset

You'll lose money investing in the stock market.

You will make money in the stock market.

You cannot predict the future.

Investing requires discipline.

It's critical to separate your emotions from your investments.

You'd better be able to keep your cool while others irrationally sell as the market tanks.

You'll keep your positions because you didn't let your emotions cloud your judgment.

Learning to separate your emotions will also help you if you decide to start a business.

Develop a winning mindset by:

Thinking long-term.

Not getting emotionally involved with your investments.

Practice self-control and discipline with your investments.

Preparing for your retirement.

Have an investment strategy for your stock market portfolio.

Related - 5 Ways How To Transform Your Mind A Winning Mindset

🤑How Taking Action During Market Downturns Make You Rich

Taking action during market downturns is how you build wealth.

You're able to purchase more shares in an appreciating asset.

Stop overcomplicating your investing strategy.

Keep things simple.

Accumulate shares in companies over time to become rich.

💰1. Keep A "Buy List" Of Strong Companies On Your Watch List

Keep a watch list of companies that you want to own.

Track these stocks or index funds using Yahoo Finance, Seeking Alpha, or another stock tracking app.

Be patient. Wait for the company's prices and P/E ratio to come down.

You can buy it at a better price to save money and get a higher return on your investment.

Monitor your buy list for when they enter your buy zone.

Your buy zone is when the stock is no longer expensive.

You buy at a discount to buy a cheap asset so you can profit and build wealth as the asset accumulates value in the stock market.

💰2. Set Aside Cash For Buying Opportunities

Keep 10-20% of your portfolio in cash.

Cash gives you liquidity to act when the market dips.

You can keep some cash in a high-yielding savings account to earn more interest while you wait for buying opportunities.

You can keep a percentage in cash in a brokerage account to immediately act to make purchases.

A cash reserve allows you to use your liquid cash to buy stocks when they're low to increase your net worth.

💰3. Dollar Cost Averaging

Spread out your purchases over weeks and months.

Don't buy shares all at once.

You're practicing dollar cost averaging when you purchase in stages.

Dollar cost averaging allows you to buy when the stock market goes down.

You buy more shares as the market declines.

You're able to own more using dollar cost averaging.

Owning more shares means you have more financial assets that can increase in value and pay you dividends.

Dollar cost averaging over time in the market helps you become rich.

💰4. Ignore The Noise

Ignoring the noise makes you focus on logic over emotion.

Turn off the financial news.

Stop following financial talking heads and influencers.

Research the names that you're interested in.

Focus on the business quality.

You're making investment decisions based on your investment strategy to build wealth.

💰5. Think In Decades, Not Days

Short-term thinking is the enemy of investing.

Long-term thinking is how you succeed as an investor.

Don't think in days. Think in decades.

Thinking in decades helps you to hold your investments through market volatility and downturns.

Long-term thinking is how you build wealth and become rich.

🏁Summary

Fear allows you to buy companies listed on the stock market.

Be greedy when everyone is afraid.

When the next crisis hits, remember:

Fear = Sale prices.

Uncertainty = Opportunity.

Patience = Profit.

Buy the next market dips and crashes to become rich!

Disclaimer: This content is for educational, entertainment, and informational purposes only. This is not financial, investment, or any advice. I write online about topics I find interesting. I make mistakes just like everyone else. Always consult a professional before making health, life, financial, investment, tax, or legal decisions.