7 Simple Ways To Reclaim Control Of Your Money

Are you financially stuck? Apply these seven financial steps to reclaim control of your money!

Money is a valuable tool. The problem is that you do not learn about money until you earn a paycheck. Even then, you may decide to spend money and live beyond your means.

I went out to bars by myself and with friends in my twenties. I enjoyed going to cocktail bars. Cocktails were all the rage when I was in college.

I did not understand the first thing about how money worked. I learned later about the importance of following a budget.

1. Shift Your Mindset

Don't beat yourself up about your current financial situation.

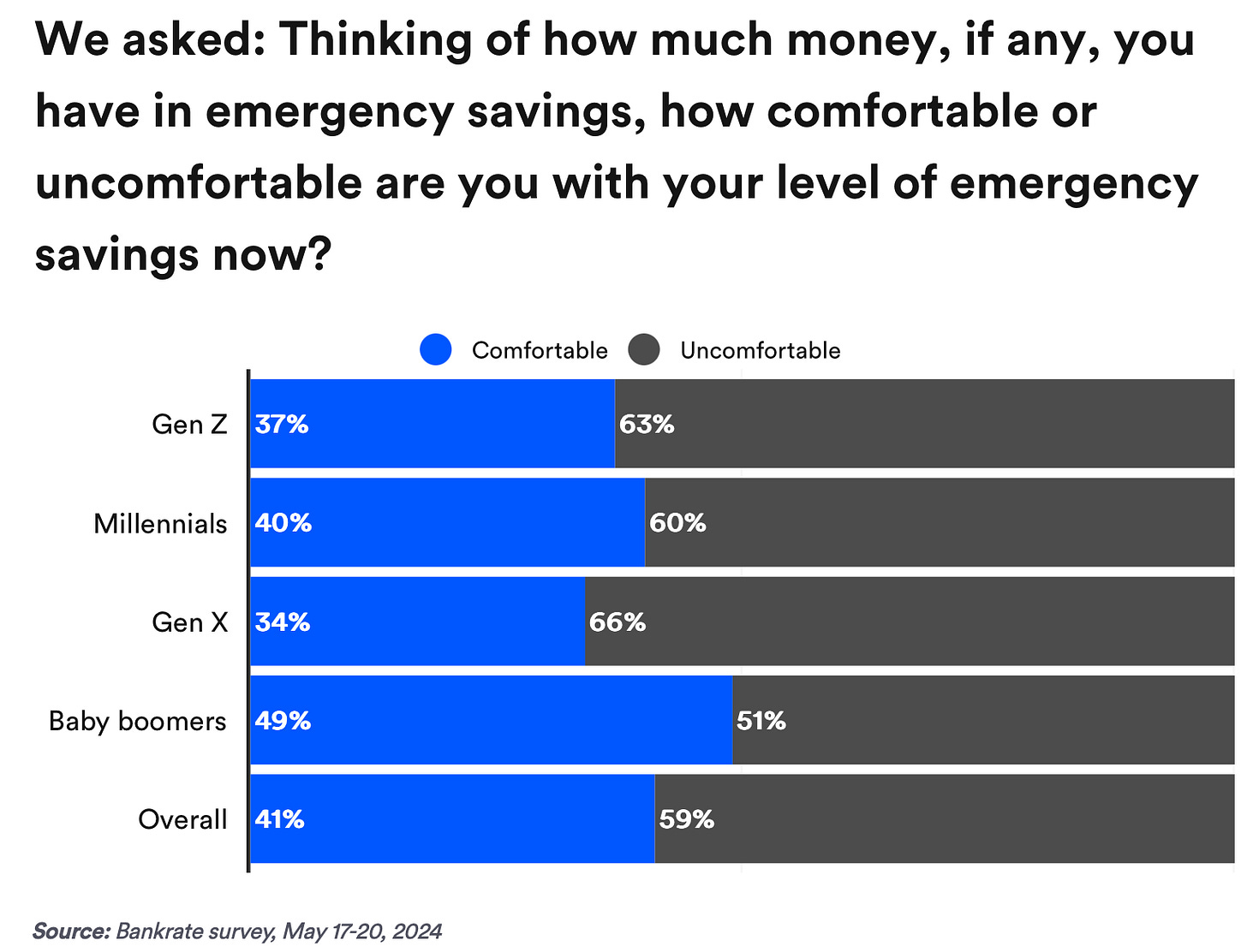

Did you know that 59% of Americans don't have $1,000 saved for an emergency?

You're not alone in dealing with this financial struggle.

Money struggles do not make you a failure.

The school system does not teach personal finance. You learn about personal finance independently or by reading content like this.

Life happens.

Finding work that pays enough to keep a roof over your head is becoming more difficult in the gig and creator economy.

You're taking the first step by starting to become financially literate. That is a mindset shift.

Change how you view money. Rather than spending it immediately, start to think long-term about money.

2. Track Every Penny You Spend

Start by tracking every penny you spend.

Tracking your spending is the first step in creating a budget.

Monitor everything that you purchase:

Bills

Coffee

Going out to eat

Going out to the bar

Subscriptions

Impulse purchases

Start out using a free budgeting tool. Upgrade to a premium tool once you have the basics of following a budget down.

Popular budgeting apps are:

Mint

YNAB (You Need A Budget)

Trim by OneMain

Rocket Money

EveryDollar

Tracking your expenses shows you where you're spending your money.

It enlightens you where you can cut back on. You can then build positive financial habits.

3. Start Small

Set a small financial goal of money to save each month.

When you're struggling or not making much money, saving 20% of your income is difficult.

Save as much as you can every month.

Set an initial small savings goal of $5 a week. That's an extra $20 a month or $240 a year.

Place a jar on your kitchen counter. Place any money you find or have in the jar to build up your savings.

Open up a savings account with your bank. Make it a habit to transfer money every month. Automate this step once you have enough money coming in every month.

All things start small. That holds true with your finances, too!

4. Tackle Your Debt

Debt hinders your ability to save and invest money.

Interest on debt eats away at your income.

You end up with less money to save.

So, what can you do?

Use The Avalanche Method

Pay off your debt with the highest interest first.

The faster you pay it off.

The more money you'll have available to save.

5. Follow A Barebones Budget

Make your budget simple.

A budget tracks your spending and saving habits.

Use a variation of the 50/30/20 budget as a rough guide to a barebones budget.

The 50/30/20 budget works like this:

50% of your income is for needs (rent, food, insurance, transportation, bills).

30% of your income is for wants (entertainment, dining out, subscriptions).

20% of your income is for debt repayment, saving, and investing.

The barebones budget reduces the amount you spend each month on wants.

You now have extra money to pay off debt and save money.

6. Live Below Your Means

Live below your means by spending less than you earn each month.

Find ways to enjoy yourself without spending lots of money.

You don't need to spend money to enjoy yourself.

Consumerism convinces you that you must spend money to have a good time.

Reduce your spending by:

Cooking at home: Learn to cook. Being able to cook at home saves you the costs of eating out. The food you cook at home is healthier than going out to eat.

Canceling subscriptions: Do you have any subscriptions that you don't use? Cancel them. That’s extra money you can save.

Hosting game nights: Host a game night or watch a movie at home instead of going out.

Shopping smart: Use digital coupons, cashback apps, shop sales, and secondhand stores.

Living below your means is a critical step to building wealth.

But first, you need to get your financial life in order.

7. Find Ways To Boost Your Income

Traditional jobs that pay well and provide benefits are becoming harder to find.

There are many options to increase your income since gig and part-time jobs have become the norm.

Some of your options are:

Explore side gigs.

Drive for Uber or deliver food with DoorDash. I was a Grubhub food delivery driver in college.

Freelance on sites like Fiverr, Upwork, and LinkedIn.

Sell things that you don't need.

Sell items on Facebook Marketplace, eBay, or Poshmark. You can even have a garage sale.

Upskill and learn in-demand skills

Study for certifications

Keep up with trends in your industry

Learn in-demand skills and make a career change

Pick up temporary or part-time work.

Negotiate and ask for a raise.

Turn your hobbies into income.

Rent out things you own.

Stay consistent in working to increase your income.

The cost of living is not going down.

The best solution is to work to increase your income.

Summary

You're the one who is responsible for your financial situation. The great news is that you can improve it by applying these seven steps to reclaim control of your money.

Heart this post ❤️and subscribe to Secure Single by James Bollen to receive more content that helps you grow, flourish, and thrive so you can live your best life!

Disclaimer: This content is for educational, entertainment, and informational purposes only. Always consult a pro before making major life, financial, and legal decisions.