Altria: One High Dividend Paying Stock To Build Wealth

Altria (MO) is a sin stock you'll want to keep an eye on. MO pays a high dividend for income-focused investors.

Altria (MO) has strong brand recognition in the tobacco industry. Altria is best known for its iconic brands, which include Marlboro, Copenhagen, and Skoal.

The company continues generating massive cash flows despite declining smoking rates in the United States. Altria has a loyal customer base due to the company's brand reputation.

Altria’s Business Model

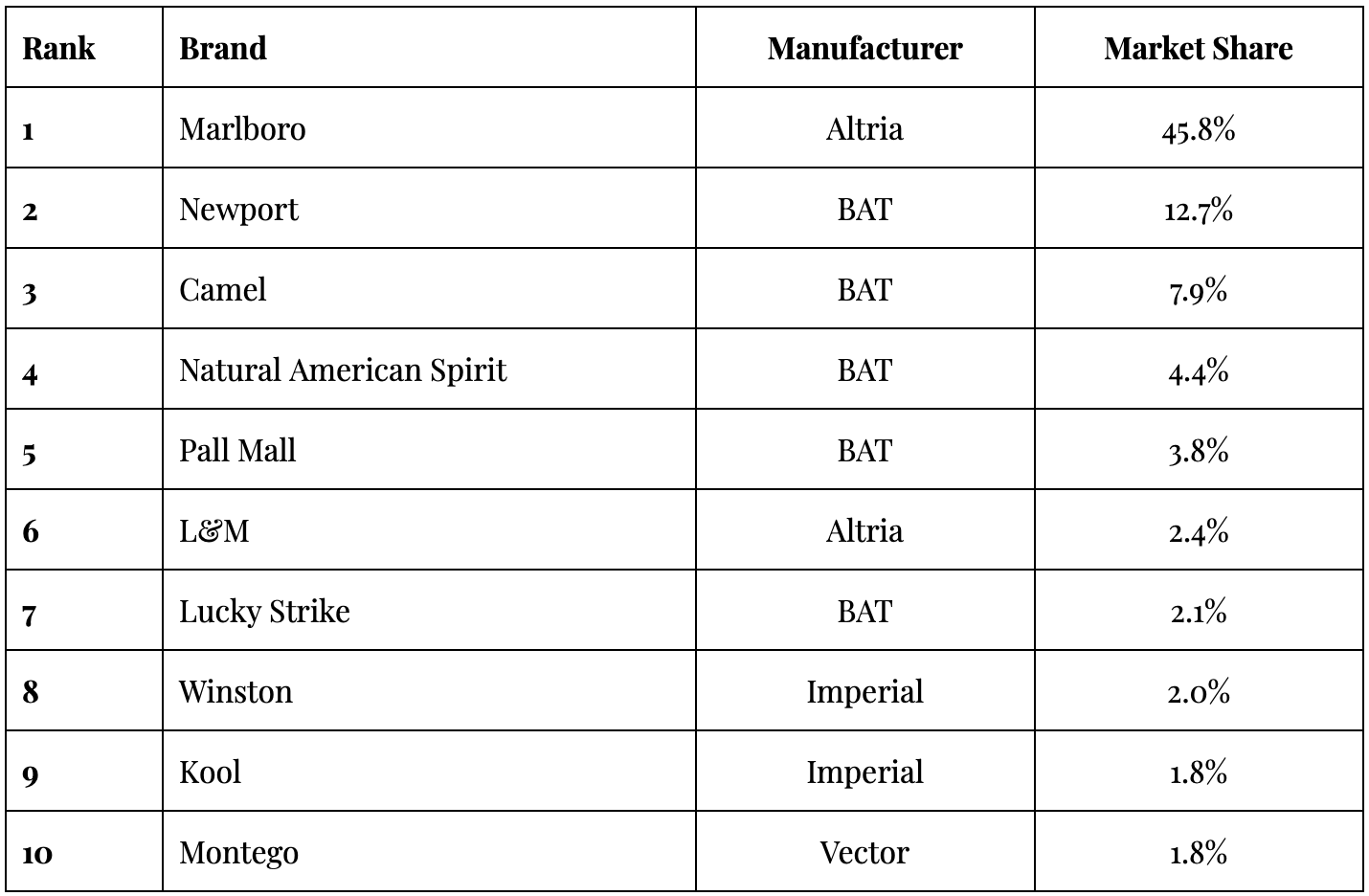

Altria’s core business revolves around cigarettes. According to Tobacco Insider, Marlboro accounts for over 45% of the United States' tobacco market share.

Even as smoking rates decline, the company offsets volume losses with consistent price hikes. Tobacco users are notoriously price-insensitive, allowing Altria to maintain profitability.

Beyond traditional cigarettes, the company has a strong presence in smokeless tobacco with Copenhagen and Skoal.Altria is entering the vaping space, which has grown in popularity among millennials and Gen Z.

Altria has attempted to diversify into reduced-risk products and tobaccoless products. According to CNBC, Altria had a failed $13 billion investment in Juul. According to an SEC filing, Altria held a $1.8 billion stake, representing roughly 45% ownership, in Cronos Group. These bets have yet to pay off for Altria. However, Altria is working to adapt to changing consumer trends and habits.

Tobacco is notorious for its regulations. However, according to Open Secrets,

"Altria works with the FDA on regulations regarding smoke-free products, and publicly takes the stance that tobacco use is harmful but cessation should be pursued through a harm reduction lens rather than through prohibition.'"

Tobacco is a major lobby that spends millions of dollars a year in D.C. Altria is one of the tobacco companies that spends the most on lobbying to protect its interests.

Financial Health

P/E Ratio

Altria has a P/E ratio of 9.5x. A fair P/E ratio of Mo is estimated to be around 18x.The current average P/E ratio of the tobacco industry is 23.1x.

MO is one of the longest-running value stocks in the stock market, making it a popular choice for dividend investors.

Key Point: A low P/E ratio indicates that the stock market may be undervaluing the company.

Current Share Price Versus Fair Value

MO currently trades around $60 a share. The stock market presently undervalues Altria. A fair value of price for Altria is $120 a share.

Key Point: MO has upside potential for investors.

PEG Ratio

Altria has a PEG ratio of 0.40. The PEG is pricing in modest earnings expansion. Altria's PEG ratio of 0.40 is superior to the median PEG ratio of the tobacco industry, which is 3.73.

Key Point: The PEG ratio under 1.00 shows that the stock market undervalues MO.

Debt-To-Equity (D/E) Ratio

Altria has a debt-to-equity ratio of -7.42.

There are debt concerns with Altria. Altria currently carries a heavy debt load due to past acquisitions of Juul and share buybacks.

Altria's debt is manageable at the company's current cash flows. MO currently has negative shareholder equity. Negative shareholder equity could be a concern for long-term dividend investors.

Key Point: A high debt-to-equity ratio of -7.42 could become problematic if earnings decline, affecting MO's ability to pay dividends to shareholders.

Dividend Yield

Altria’s dividend pays shareholders $4.08 per share.

MO's 68.5% payout ratio indicates that the company allocates earnings to shareholder dividends.

MO’s 6.92% dividend yield is one of the highest in the S&P 500. Altria has consistently raised its dividend and paid its shareholders for 56 consecutive years.

Key Point: The 6.92% dividend is attractive but relies on stable cash flow.

Bull Case: Why Altria Remains A Top Income Stock

1. Unmatched Dividend Yield

MO’s 6.92% dividend yield is one of the highest in the stock market. Altria remains a favorite for income-focused investors. With a decades-long track record of dividend increases, Altria is a dividend king. MO will appeal to you if you're seeking reliable passive income.

2. Pricing Power and an Addictive Product

Cigarette demand is inelastic. Smokers rarely quit due to price hikes. An addictive product allows Altria to raise prices annually, protecting margins even as volumes decline.

Altria is moving into vaping. Vaping is a popular choice among younger generations. Vapes are an additional product to its extensive tobacco line.

3. Defensive Business Model

Tobacco is recession-resistant. People continue to smoke even during economic downturns. People likely will smoke more due to poor financial situations. This stability makes MO a solid hedge against market volatility.

4. Potential Upside In Reduced-Risk Products

Altria’s investments in oral nicotine pouches, cannabis, and vaping can gain traction with changing consumer behavior toward tobacco. Altria could offset cigarette declines over time. Altria would have products for the next generations of tobacco users.

Bear Case: The Risks That Could Sink Altria

1. Irreversible Smoking Decline

The United States continues to see smoking rates decline. The decline of smoking will continue as people prioritize their health. Price hikes can’t compensate forever or reverse the trend of lower smoking rates.

2. Regulatory Threats

Altria has limited financial flexibility. The company has high debt, and interest rates are currently at a moderate level. A drop in earnings could force MO to cut its shareholders’ dividends.

3. Debt And Dividend Risk

Altria has limited financial flexibility due to its high debt and interest rates. A drop in earnings could force MO to cut its shareholders’ dividends.

4. Failed Innovation Bets

Juul and Cronos were failed investments by Altria. The failed investments raise doubts about Altria’s ability to pivot away from traditional cigarettes.

Read Next

NVTS: An Irresistible Revolutionary Company Set To Skyrocket

Navitas Semiconductor (NASDAQ: NVTS) positions itself as a pivotal player in the next generation of powering electronics.

Summary

Whether Altria is worth investing in will depend on your investment style.

If you prioritize dividends, MO is a strong buy. The 6.92% yield is attractive. MO is a strong and stable company. The company has a consistent cash flow that should support payouts for years to come.

If you're a growth investor, look elsewhere. Smoking declines, and regulatory risks limit the company's upside, making MO a value trap for growth-focused portfolios.'

If you have a balanced portfolio, hold MO with caution. Monitor the debt and regulatory developments closely. Diversify into other industries to make your portfolio less tobacco-heavy.

Disclaimer: This content is for educational, entertainment, and informational purposes only. This is not business, financial, investment, or any advice. I write online about topics that interest me. I make mistakes just like everyone else. Always consult a professional before making health, life, finances, investments, taxes, or legal matters.