Debt And Suicide

There is a relationship between financial health and mental health. There are seven steps you can follow to get out of debt.

There is a depressing relationship between debt and suicide. This dark relationship makes sense if you think about it. If someone is strapped with debt and thinks they have no future, especially after doing everything they were told to do. One could ask, what is the point of living? They have no hope of getting ahead in life. Especially in modern America, where it is becoming increasingly difficult to get by, let alone afford a house, pay a mortgage, get by living on necessities, and find a job that can pay you enough to survive.

This article ends with seven steps you can implement to get out of debt.

If you or someone you know does not think there is hope or a way for them to pay off debt, there are always solutions.

Debt Based System

America’s financial system is based on debt. The dollar is backed by debt. The economic system's foundation, via the Federal Reserve and Central Banks, is a debt-based currency.

The United States economy is reliant on debt. There is a debt bubble. It continues to expand with credit cards, student loans, mortgages, et cetera. This is a fiat Ponzi scheme that benefits the banks and Central Banks. The Federal Reserve creates bubbles by propping up areas of the financial economy, from real estate to the stock market. Central banks are a vital part of a centrally planned economy.

It is in the interest of the financial system that you be in debt. Debt slavery is neocolonialism. Debt is a hidden form of slavery. Personal debt is neocolonialism on the micro-level. World banks, like the International Monetary Fund (IMF), practice neocolonialism globally, targeting countries on a macro-level to indebt entire nations.

American Debt Statistics

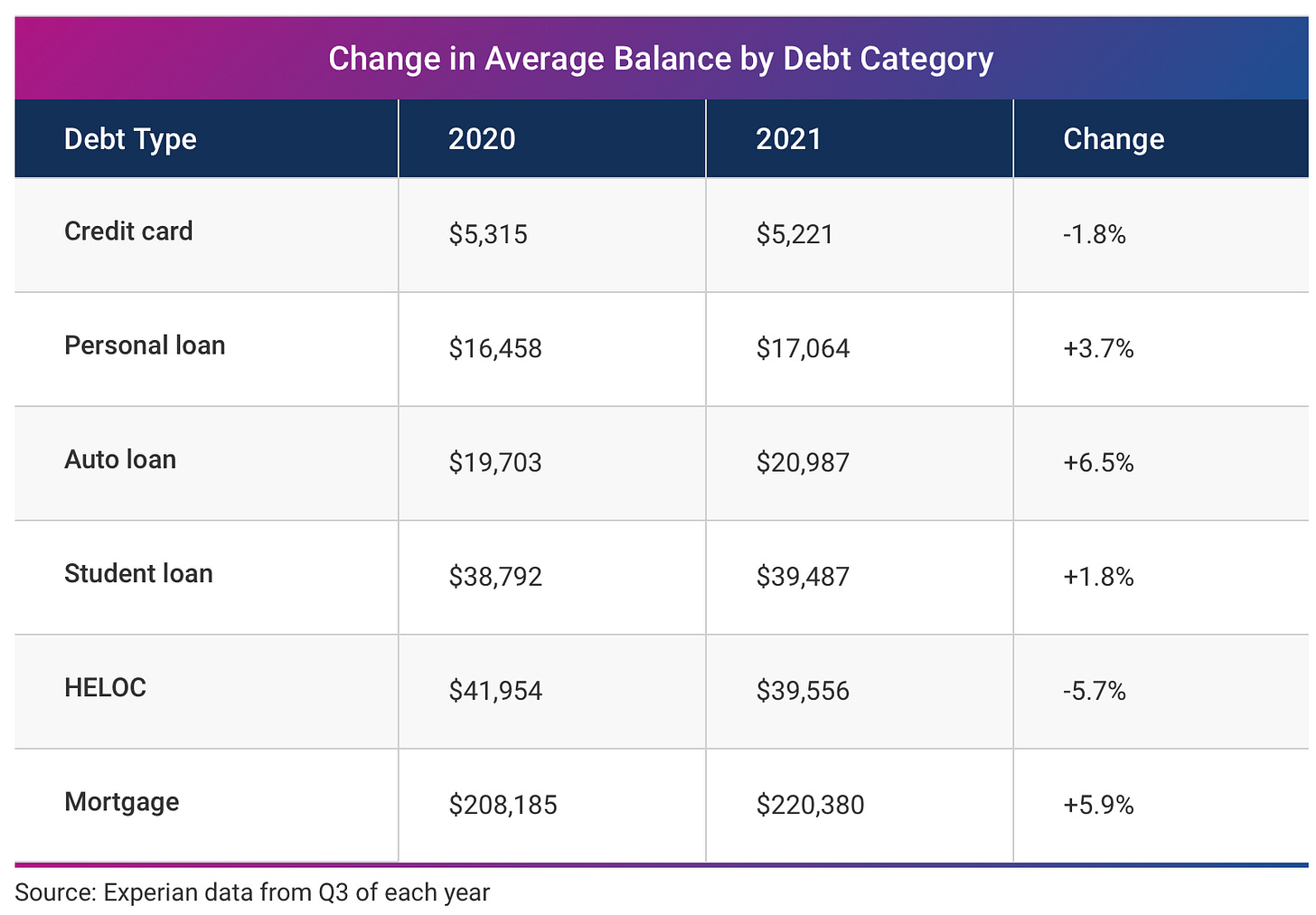

The financial data for the average American’s money management is pretty bleak. Americans are trained to accept debt as a part of financial life once a bank approves their first credit card to go into debt to attend college. Experian summarizes the Average American’s debt balance from 2020 to 2021 below.

Credit Karma lists the amount of debt per generation for 2022.

Debt is accepted as a part of American life. The range of debt ranges from $15,825 to $60,063 and includes “auto lease, auto loan, credit card, mortgage, student loan and total debt” in Credit Karma’s methodology.

Most Americans Don’t Have $1,000 For An Emergency

Most Americans do not have enough money saved for a rainy day fund which can later become an F.U. fund. CNBC found that 56% of Americans don’t even have $1,000 to cover an emergency from their savings. That means if something happened to their car, a health issue, or another problem arose, the average American would be unable to reach into their savings to cover it.

They will most likely put the issue that arose onto their credit card. This further puts them into debt, feeding many Americans' debt spiral. Debt has been found to relate to mental health problems.

Debt And Mental Health

A study by PLo$ One found that the “Global financial crisis (GFC) and the associated adverse economic sentiment, triggered by the collapse of the housing market in 2008, would increase suicide, homicide, and murder-suicide rates.”

Ramsey Solutions research found, “Nearly half (46%) of Americans say their debt level creates stress and makes them anxious. Among the generations, 64% of Millennials reported the most stress and anxiety, followed by 52% of Gen Xers and 27% of Baby Boomers.”

A study by Yerko Rojas in the International Journal of Social Psychiatry found, “Debt repayment problems have a significant and detrimental impact on individuals' risk of committing suicide, even when several other socioeconomic risk factors are controlled for.”

The relationship between being in debt and having poor mental health makes sense. After all, if you cannot save money each month to help you plan for your future, you feel stuck. You can then become depressed, even suicidal.

Your financial health is linked to your mental health.

7 Steps To Get Out Of Debt

List Out All Of Your Debts

Make a list of all the types of debt you currently have. The first step is to face the reality of your debt. It would help if you faced the facts. Once you know the facts and the amount of debt you have, you can work to pay off your debt. You can then come up with a plan to get out of debt.

Start A Rainy Day Fund

Once you know how much you have to pay off your debt, first start a rainy day fund. Save at least $1,000 in your rainy day fund before you start to attack your debt. Your rainy day fund will allow you to have the cash to cover emergencies to prevent you from immediately pulling out your credit card to pay for an emergency. This is a simple method to help you from continuing to go into debt.

Your rainy day fund starts as a life jacket. Your rainy day fund can eventually become an anchor to hold you steady in a financial system that wants you to be in debt. Once you pay off your debts, you can build a giant F.U. fund.

Pay Off Your Debt

The first solution is to pay off any debt you may have as soon as possible. You can start by paying off your smallest debts first. You can then start to chip away at your larger debts, bit by bit. You want to start small because you will start to see results sooner. This will help you psychologically to know that you can successfully pay off your debt. You can begin to pay off your debt by following the snowball effect.

Make a list of your debts from the smallest to your largest. Don’t worry about the interest rates.

Plan to make the minimum payments on all of your debts except for your smallest debt.

Pay as much as you can to pay off your smallest debt.

You can repeat this method until all of your debts are paid off.

You will start to pay off your smallest debts first. You will eventually be able to pay off your medium and large debts. You can start small by paying off your smallest debts first before paying off your large debts. Begin small; like a snowball, it will become larger until your debts are paid off.

Live Below Your Means

While paying off your debt, make a point to live below your means. Cancel all the subscriptions you don’t need or use and don’t help you improve yourself. These would be entertainment subscriptions. You can stop going out to eat. You could stop buying the name brands and instead purchase the store brand. You can eliminate unnecessary expenses to direct more money to pay off your debts.

Find Ways To Make Extra Income

You can work to find ways to bring in extra income to help you pay off your debt. You could pick up extra hours and work overtime when it is offered. You could pick up a part-time job to supplement your full-time job. You could find random jobs in your area to bring in extra money. You could become a freelancer on a site like Fiverr or Upwork. You could resell anything that you no longer use or need on resell sites like Facebook Marketplace.

Bringing in extra income can help you to pay off your debt sooner.

Don’t Give Up

Never give up. Debt is common. You are not alone. You can pay off your debts. Your debt is preventing you from reaching other financial goals.

You can go from being in adverse financial health to experiencing positive financial well-being. Your mental health will improve once your finances improve.

Paying off all of your debts and becoming debt free is your first step toward financial freedom.

Find Ways To Make Passive Income

You can work to find ways to make passive income. Passive income takes longer to generate compared to active income. You could work to write a book. You could create a website or YouTube Channel and eventually make money from advertisements and affiliate marketing. You could start a paid newsletter. You could sell merchandise. You could sell digital products, from music clips to digital courses.

You always want to find ways to increase your income.

We’re not for everyone.