DigitalBridge: An Unknown, Innovative REIT That Could Make You Rich

DigitalBridge (NYSE: DBRG) specializes in high-tech real estate that the internet relies on.

DigitalBridge (NYSE: DBRG) is a critical player in building the digital world you rely on every day.

I'll be reviewing the company’s business model, management strength, competitive advantages, financial health, and the bull versus bear case arguments.

DigitalBridge is an unknown, innovative REIT that could make you rich.

1. Investment Thesis: DigitalBridge (DBRG)

DigitalBridge is a high-growth digital infrastructure private equity firm specializing in data centers, cell towers, and fiber networks. These are all critical assets powering the 5G, AI, and cloud computing boom.

DBRG has strong leadership, strategic partnerships, and exposure to secular tailwinds.

The company is well-positioned to benefit from the world’s increasing reliance on digital connectivity.

Why Consider Investing?

DBRG has a rising demand for data storage, and its faster networks fuel expansion

CEO Marc Ganzi has a proven track record of managing digital real estate.

The company has long-term contracts with tech and telecom giants to bring in steady cash flow.

DBRG is currently trading at or above some analysts' fair value estimates, ranging from $15 to $20 per share.

Investment Risks

DBRG has debt, and rising interest rates could place pressure on the company's profits.

There is growing competition in the space from competitors like Digital Realty that dominate specific market segments.

Technological disruptions, such as satellite internet, could pose a threat to traditional infrastructure.

Verdict

DigitalBridge offers a great long-term growth play for investors bullish on digital infrastructure.

While DBRG is not without its risks, its niche focus, strong leadership, and industry tailwinds make it an attractive investment at the current price point.

Key Point: DigitalBridge provides investors with the opportunity to invest in digital infrastructure that is essential to modern life.

2. What Does DigitalBridge Do?

DigitalBridge operates as a real estate investment trust (REIT). DBRG owns and manages income-producing digital infrastructure assets.

DigitalBridge specializes in high-tech real estate. The company's high-tech real estate includes:

Data centers

Fiber-optic networks

Cell towers

Small cell networks

These digital infrastructures are becoming increasingly valuable in the modern data-driven economy.

The company doesn’t merely own these properties passively, unlike some REITs. DBRG actively develops and manages them. DBRG often partners with major tech firms, telecom giants, and governments.

The company's hands-on approach allows DigitalBridge to maximize its returns while staying ahead of industry trends.

Key Point: DigitalBridge generates revenue by investing in and managing the physical infrastructure of the internet and communication networks.

3. Does DigitalBridge Have A Competitive Edge?

DigitalBridge has three distinct moats that give the company a competitive edge.

Upfront Capital

The digital infrastructure industry requires massive upfront capital. The high upfront investment cost makes it difficult for new competitors to enter the market. Building data centers or laying fiber-optic cables isn’t cheap. Established players like DigitalBridge benefit from economies of scale.

Long-Term Contracts

DBRG secures long-term contracts with major clients, including cloud providers and telecom companies. These long-term contracts ensure steady cash flow for the company.

Laws And Regulations

Government laws and regulations make it both cost-prohibitive and add additional legal complexities. Laws and regulations increase the difficulty of new competitors entering the specialized REIT market.

Government regulations and zoning laws create barriers to entry.

Obtaining permits for a new company to develop new infrastructure is a slow and costly process.

Three Moats

DRBG's three moats aren't impenetrable. Larger competitors, such as Digital Realty and American Tower, dominate specific segments of the market.

However, for newer, smaller companies to enter the field is more difficult due to the lack of connections, upfront capital costs, and navigating the legal complexities.

Key Point: DigitalBridge has solid moats due to its high costs, long-term contracts, and legal hurdles, which help protect the company from oversaturation.

4. Is DBRG's Management Team Strong?

The DigitalBridge management team is experienced, and the CEO has a long history of holding high-level roles in digital infrastructure companies.

CEO

DigitalBridge's CEO, Marc Ganzi, is a veteran in digital infrastructure. He has successfully led ventures in the data center and wireless network industries.

Marc Ganzi has served as the President and CEO of DigitalBridge Group, Inc. since 2022.

From 2020, Ganzi served as President, CEO, and Director of DigitalBridge Group Inc. He served as the Managing Director of DigitalBridge Group Inc. from 2019 to 2020.

He first joined Digital Bridge Holdings, LLC in 2013. He was the Co-Founder of Vertical Bridge REIT, LLC in 2023. Ganzi was the Executive Chairman and Co-Founder of Vertical Bridge REIT, LLC until 2023.

Marc Ganzi was the Chairman, Founder, and CEO of Global Tower, LLC. He remained the Chairman and CEO of Global Tower, LLC until 2017.

Leadership Team

The average leadership team member at DigitalBridget has 2.5 years of experience and is 53 years old. DBRG has an experienced management team to handle the day-to-day operations of the business.

The leadership team's stake in the company ranges from 0.037% to 1.67%. The percentage stakes incentivize the leadership team to grow the company's profits, so they can increase their income.

Board Members

DigitalBridge's board of directors has an average tenure of 4.8 years. The average age of the company's board members is 62 years old.

Executives' Stake In DBRG

The company's executives have personal stakes in the company. The management team possesses deep expertise in private equity, law, real estate, accounting, finance, and technology.

The executive team offers a well-rounded perspective on where the industry is headed and how to overcome the various hurdles the company will face.

Executives on the leadership team and board members hold stakes ranging from 0.0033% to 1.67% in the company.

The percentage stakes incentivize the leadership team to grow the company's profits, so they can increase their income.

Shareholder Angle

From the perspective of a shareholder, DigitalBridge's management team is prioritizing the business' success. The CEO, leadership team, and board all have experience in their respective fields related to digital infrastructure.

It's in the mutual interest of all parties for the company to grow and be financially successful. The financial success of DBRG translates to a rising share price for its shareholders.

Key Point: The financial success of DBRG translates to a rising share price for its shareholders.

5. How Is DigitalBridge Valued?

Market Valuation

DigitalBridge has a market cap of $2.1 billion. The company's market cap has decreased by 9.78% over the last year.

Revenue

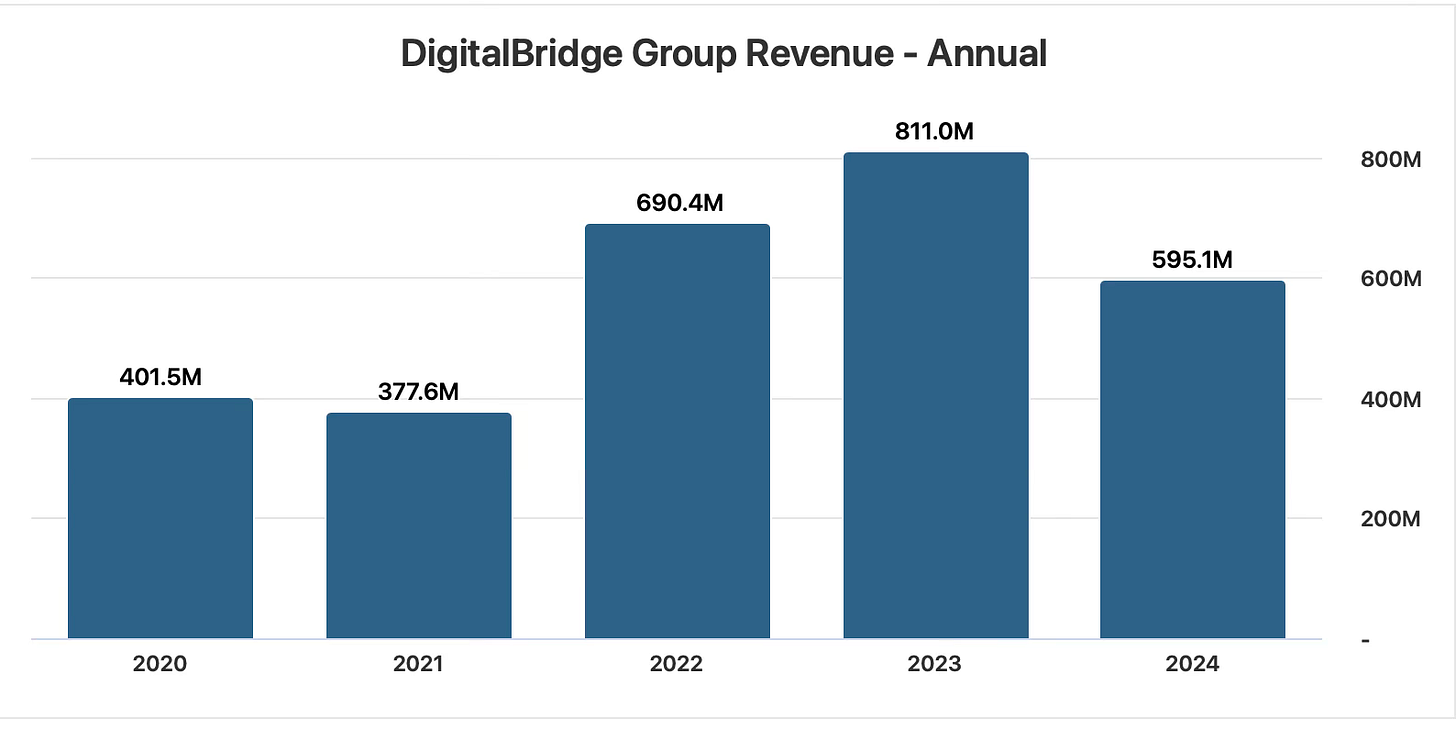

DigitalBridge reported earnings of $595.1 million in 2024. DBRG has generated $43.09 million in the first quarter of 2025.

DigitalBridge's revenue growth has declined by nearly 35% in 2025.

Key Point: DigitalBridge is fairly valued, with strong growth prospects; however, the company's market valuation and revenue have declined over the past year.

Receive 20% off an annual subscription forever to receive five undervalued stock picks a month to grow your passive income and capital appreciation in the stock market. That’s less than the price of five bad dates a month with dinner and drinks.

6. Is DBRG Financially Healthy?

I'll next examine several critical ratios to determine if DBRG is financially healthy enough for you to consider investing in.

Keep reading with a 7-day free trial

Subscribe to Secure Single by James Bollen to keep reading this post and get 7 days of free access to the full post archives.