Exposing 10 Common Money Lies That Keep You Broke (Part 2)

Are your financial habits keeping you poor? Here is part two of a series exposing common money lies that keep you broke.

Are you tired of being broke? Or you want to discover bad financial habits that you have that you can cut back on to allow you to save and invest more money. Here are ten common money lies that keep you broke.

Lie #11: I Accept The First Job That Comes Your Way

It is common to accept the first job offer that comes your way. But by doing so, you compromise. By doing so, you can avoid compromising and missing out on new opportunities. The next opportunity could offer better pay, a better work culture, or a job that fits your interests and skills.

Solution

Instead of constantly compromising, embrace self and professional growth by upskilling. Learn in-demand new skills. Be patient.

Having savings and an emergency fund can help you weather the storm while you wait for the next opportunity. A rainy day fund provides financial security while you wait for a better job offer.

Lie #12: I Have An Entitlement Mentality

You have an entitlement mentality. If you have this mindset, you think you deserve or are owed something for doing nothing. Entitlement is a core characteristic of narcissism. A personality disorder where individuals have an inflated sense of self-importance. Narcissists require excessive attention and admiration, even if they have never accomplished anything.

The consequences of believing you are entitled can lead to:

Unhappiness

Relationship conflicts

Depression

Frustration

Solution

Stop playing the victim card. The cold, hard truth is you deserve nothing. You were born with nothing. You will leave this world with nothing. The world will continue after you are buried six feet under.

Embrace an abundance mindset. Be action-oriented. Look for solutions. Work hard and smart to achieve your goals.

Lie #13: I Don’t Need To Practice Self-Control With My Finances

Operating solely on emotions leads to bad outcomes, especially with money. That is why it is vital to practice self-control.

By having no self-restraint in your finances, you risk overspending. Overspending is a characteristic of living beyond your means. Overspending leads to having little to no money to save at the end of each month.

Solution

Practice self-control. Set clear and achievable financial goals for yourself. Wait twenty-four hours or a couple of days to make a purchase rather than buying it immediately. This helps you more clearly define if it is a want or a need.

Lie #14: I Will Save More Money Later

Operating solely on emotions leads to bad outcomes, especially with your money. By practicing self-discipline, you can empower yourself to make better financial decisions.

By having no self-restraint in your finances, you overspend. You then have little to no money left to save at the end of the month.

Solution

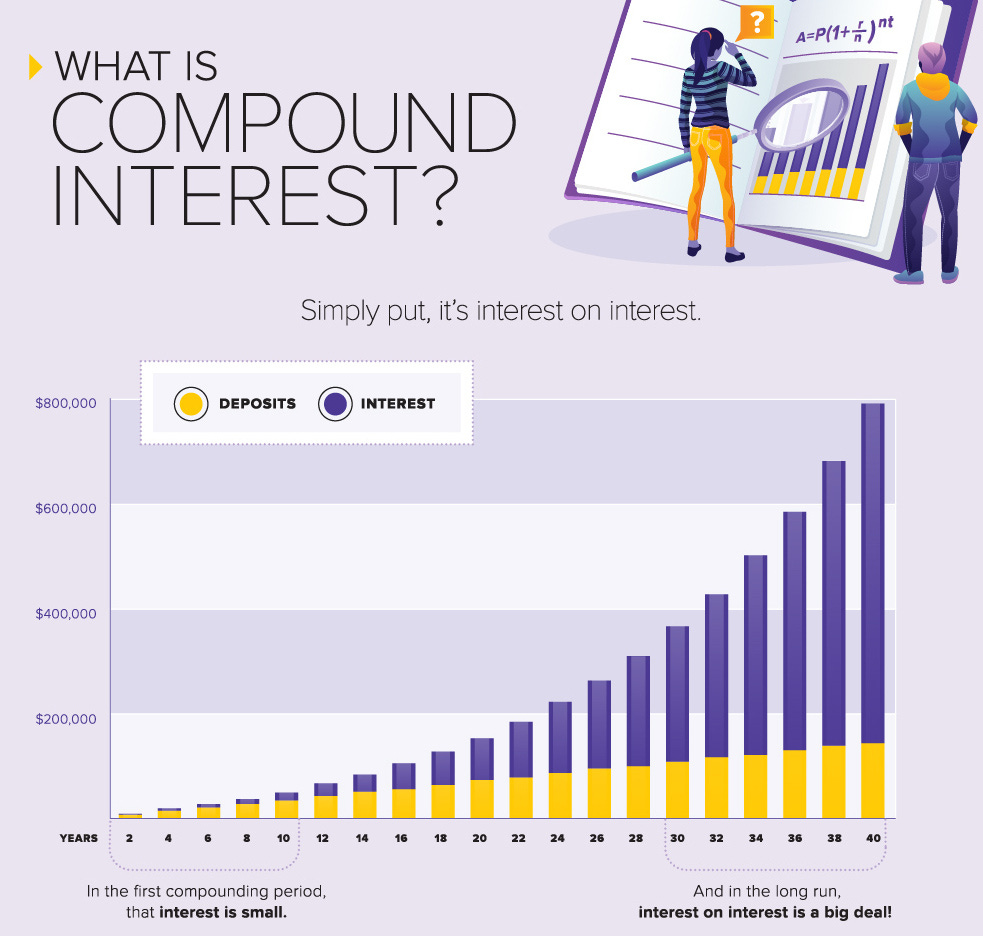

“Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it.” - Albert Einstein

The good news is you can automate your checking account. You can automatically direct a certain amount of money monthly to your savings account.

Check your settings by logging into your bank account. Look for an option called automatic savings transfer.

Once you have built it up, you can move money from your savings to a high-yield savings account. Your money will earn higher interest in a high-yield account than in a standard savings account.

Lie #15: I Will Invest More Money Later

This is similar to lie number fourteen lie, but with investing. You procrastinate with investing money. The more time you delay investing, the less time you have to make your money work for you.

Solution

If your employer offers a matching 401(k), make it a financial goal to invest the maximum amount every year. You can also invest money in an IRA or a Roth IRA. You can learn about the stock market and other financial assets.

Lie #16: I Don’t Need To Plan For My Financial Future Right Now (I Have Lots Of Time)

You may tell yourself, I am in my early twenties or thirties. I am still young or relatively young. I still have time on my side. I don’t need to take responsibility for my financial future.

You could be compounding your money and finding ways to take your time back. Or leave a job you hate. Instead, you are apathetic toward your financial future.

You never know if a medical emergency may happen to you. Or if you may get into an at-fault car accident. You can go into debt if you do not have the financial resources. You can also have personal assets taken from you to repay any debts.

Solution

Stop being indifferent about your finances. Learn about personal finance. Make a point to understand money and how the financial system works. Learn about investing. Discover the secrets of making and preserving wealth.

Lie #17: I Am A Bad Person For Wanting More Money

This belief stems from the problem (lie #1) that money is evil. While having more money will not make you happy (lie #10). It's important to recognize that money can be a force for good. It's not wrong to aspire to earn more and build wealth.

The current society demonizes the successful and wealthy. This trend is due to the entitlement mentality (lie #14). The higher education system fosters an entitlement mindset. Society further encourages the culture of entitlement. The result is that many young people think that money is evil (lie #1).

Solution

Change your mindset about money. Money is merely a tool. It can help you pay off debt, save, invest, live comfortably, and provide financial security. You can also use money to help other people.

Lie #18: I Need The Latest Technology

You purchase the latest technology. The highest-end phone, laptop, or new device when it rolls out. You only keep your technology for a couple of years until you replace it.

Solution

Do you really need the latest and greatest phone camera or laptop? How much of the technology on a device do you use? Understanding the purpose and how you will use the technology can help you make an informed choice.

Opt for refurbished or older technology that is a couple of years old. It's a smart, cost-effective choice that can save you money without sacrificing quality.

Lie #19: I Need To Buy Name Brand Clothes

Following from wanting the latest technology, you follow the latest fashion trends and buy name-brand clothes. Name-brand clothes are more expensive than non-name-brand ones since you pay for the brand or logo.

When I was in college, I was in my metrosexual phase. I would buy Guess and other overpriced name clothes. I wore skinny jeans, slim-fit dress shirts, and a modern blazer. I overspent on self-care and living a lifestyle I could not afford.

Solution

Buy off-brand clothing. Purchase the store or generic brand rather than the name brand. It will save you money. By trying to appear rich, you make yourself poorer by spending money.

Lie #20: I Need To Go Out All The Time

You go out all the time. You are spending extra money going to bars, restaurants, or entertainment that would cost you less at home. Sometimes it is good to go out, but do you need to go out every week? The cost of going out, plus paying tips, quickly adds up and shrinks your bank account.

Solutions

Learn to cook. Learn to enjoy your own company. Find free or inexpensive ways to spend time with friends or family. Spending less allows you to save and invest more money.

Secure Single’s Algorithm recommends:

Anti-Politics And Self-Development: The Shocking Link Explained

3 Financial Habits Comparison: Poor Vs Middle Class Vs Wealth

Summary

These are ten more poor financial habits that keep you penniless. Do you notice a common trend in the list? It comes down to having a poor mindset, such as entitlement and external validation, and wanting to be seen with the newest clothes or technology.

The more you spend money. The less money you will have. The more money you save and invest. The more your money and net worth will begin to grow.

Subscribe to Secure Single’s Substack for more content to chart your course toward confidence, happiness, and prosperity to thrive as a single person!

Order your copy of Thriving Solo: How to Flourish and Live Your Perfect Life (Without A Soulmate). It is now available in paperback and Kindle on Amazon.

Support independent writing by donating to the tip jar.