Exposing The Truth About Why The "Official" Inflation Measurements Are Wrong

The CPI and PCE numbers are wrong. Here is why you should use the Chapwood Index to measure inflation.

Do you feel like your paycheck disappears faster than it did last year or a few years ago? You're right.

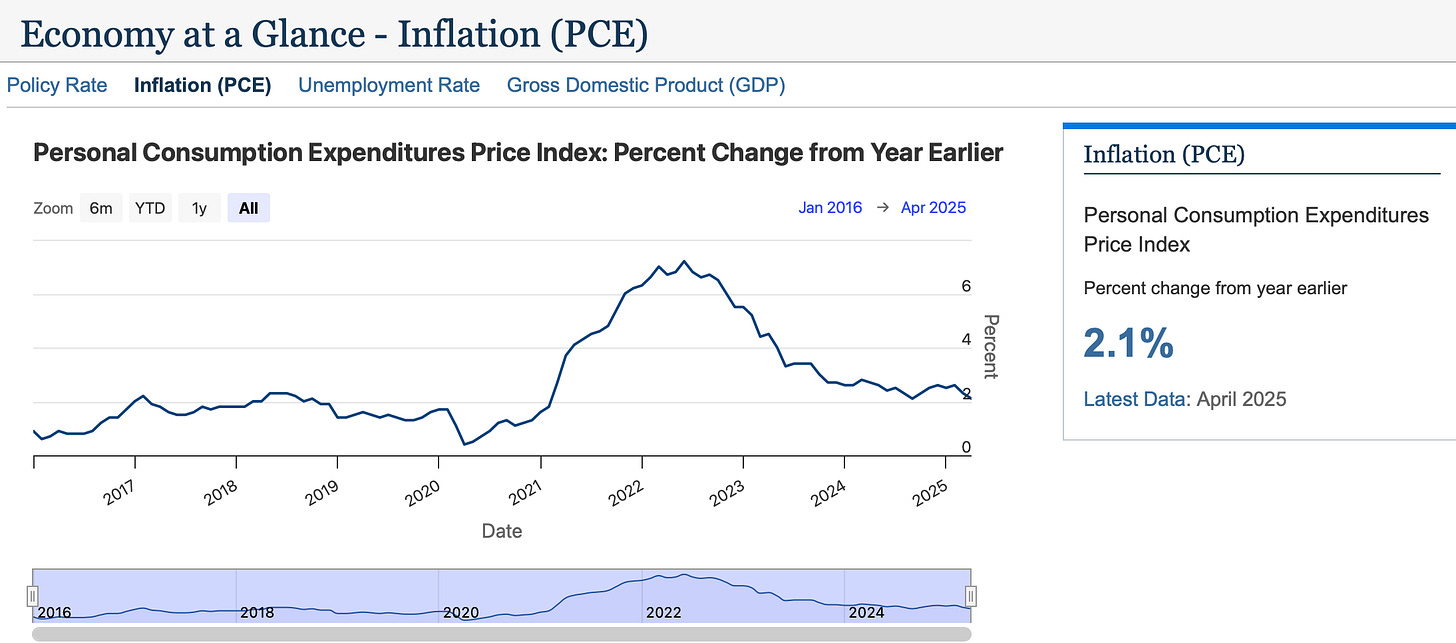

Prices continue to rise faster than the "official" Personal Consumption Expenditures (PCE) index admits. The Consumer Price Index (CPI) has the same problem.

If the two main sources that financial news uses are wrong, what can you use instead?

The Chapwood Index is a more accurate measurement of inflation than the CPI and PCE.

Problem: The “Official” Inflation Numbers Don’t Match Reality

Have you ever gone to the grocery store and thought, "Why is everything so expensive?" You’re not crazy.

Prices are increasing at a rate much faster than the "official" numbers from the government and the Federal Reserve tell you.

The Consumer Price Index (CPI) is The U.S. Bureau of Labor Statistics' inflation measurement. The Federal Reserve has the Personal Consumption Expenditures (PCE) Price Index.

But the problem with both is that they include many things you actually spend money on every day. Both numbers are lower than what you pay.

The government and Federal Reserve make adjustments to make inflation appear lower than it actually is in-store or when paying bills.

This is a big deal!

If inflation is worse than the "official" number, your paycheck isn't going far enough. Your savings lose value. Planning for your future becomes more challenging.

Believe what you're seeing and paying, not what they're saying.

Key Point: The “official” inflation numbers are misleading because they overlook your everyday expenses.

Solution: The Chapwood Index Shows The Real Inflation Rate

Meet the Chapwood Index.

The Chapwood Index is a more accurate method for tracking the actual inflation rate.

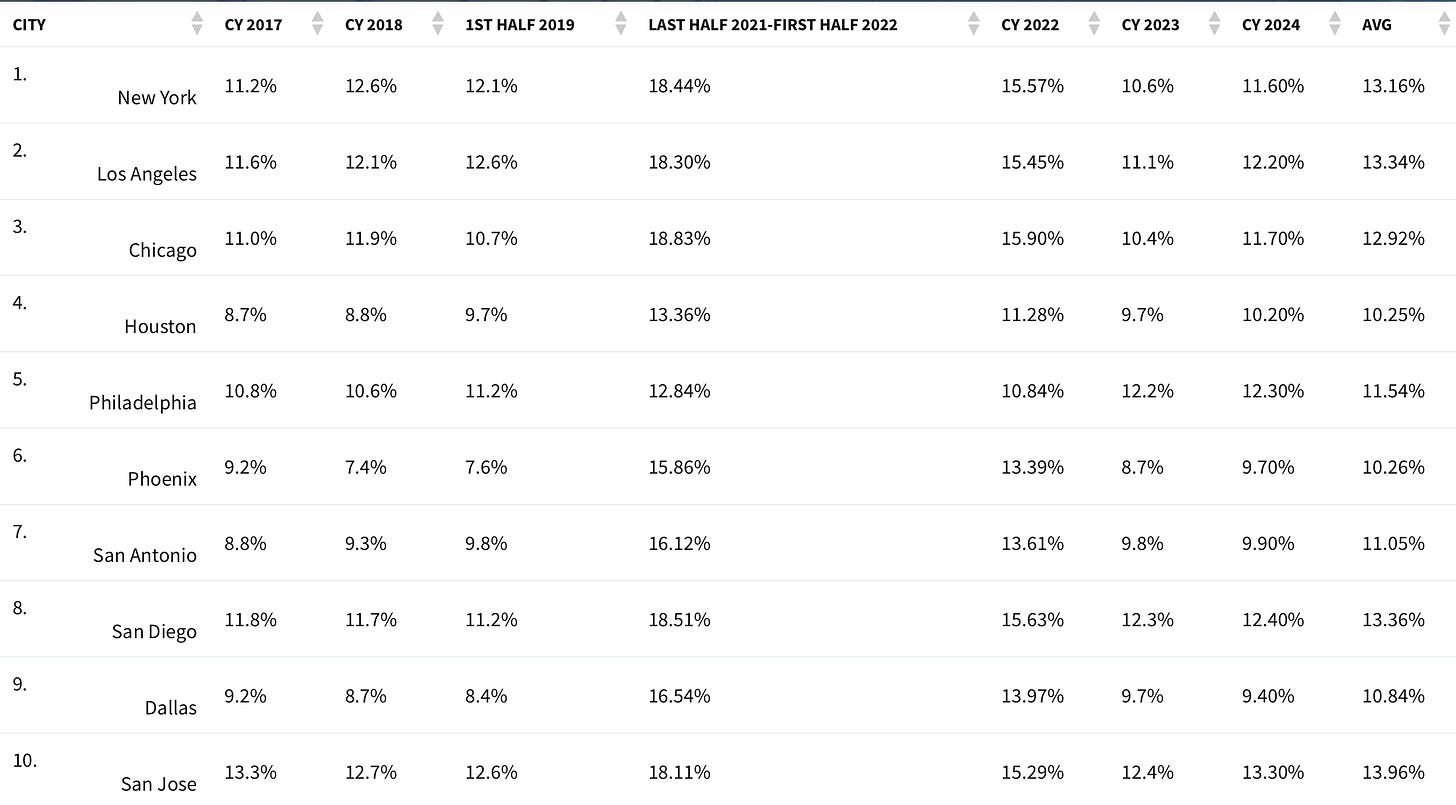

The Chapwood Index examines the actual prices of 500 items that people purchase in the 50 largest U.S. cities.

No tricks, no funny math. Just what things cost.

Here’s why the Chapwood Index is a better measure of inflation:

It includes everything: Groceries, rent, healthcare, taxes, insurance, and subscriptions.

It updates every year: You can see actual price increases.

It’s simple: There's no confusing math, adjustments, or complex calculations. It uses real numbers.

The best part?

The Chapwood Index shows that inflation is way higher than the CPI or CPE says. For example, while the government and the Federal Reserve report inflation to be under 3%, the Chapwood Index indicates it’s 10% or more.

This means that if you’re using the CPI or PCE to plan your budget or retirement, you’re underestimating how much you’ll need.

The Chapwood Index provides a more realistic number. You can make better financial decisions.

Key Point: The Chapwood Index tracks actual price changes on everyday items, revealing that inflation is significantly higher than the government and the Federal Reserve acknowledge.

Why Does This Matter?

Your financial future depends on having accurate data.

If inflation is 10% but the government says it’s only 3%, here’s what happens:

Your savings lose value faster. If your bank pays you 1% interest but inflation is 10%, you’re losing 9% of your money’s buying power every year!

Your raises don’t keep up. If your salary increases by 3% but prices rise 10%, you’re getting poorer.

Your retirement planning is way off. If you think you’ll only need $50,000 a year in retirement, but real inflation says you’ll need $100,000, you'll run out of money too soon.

The Chapwood Index helps you fight back to protect your financial future. By knowing the real inflation rate, you can:

Adjust your budget to avoid falling behind.

Invest smarter to outpace inflation.

Upskill and learn higher-paying skills to earn more money.

Start a side hustle to make it into a business to build new income streams.

Take calculated risks to invest in appreciating assets.

The government doesn't want you to know how bad inflation really is.

Why?

Inflation is a silent and invisible form of taxation.

The Chapwood Index provides a more accurate reflection of reality.

Key Point: Understanding the actual inflation rate enables you to effectively protect your savings, income, and financial future.

Summary

The stats from the government and Federal Reserve are massaged to look good.

The Chapwood Index is closer to reality.

Stop letting hidden price hikes wreck your finances.

Check the Chapwood Index, plan for a higher inflation rate, and regain control of your finances.

Disclaimer: This content is for educational, entertainment, and informational purposes only. This is not business, financial, investment, or any advice. I write online about topics that interest me. I make mistakes just like everyone else. Always consult a professional before making health, life, finances, investments, taxes, or legal matters.