Shocking: Why $100k Is The New $80k And 5 Way How To Build Wealth

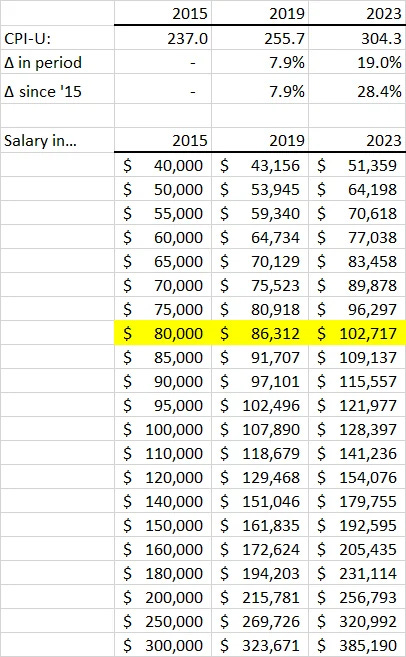

$100k is now worth what $80k was worth a few years ago.

An $80,000 salary once meant a comfortable life. Now, $80,000 means that you're barely scraping by.

Inflation and currency devaluation cause your money to lose value each year.

Your wages fail to keep up with the cost-of-living crisis.

$100,000 is the new $80,000.

Inflation and currency debasement destroy the middle and working classes.

My grandpa told me when I was growing up that "Inflation is the biggest enemy of financial success." I had no idea what inflation was until the last five years. Since learning about it and experiencing it, I've always looked for ways to stay ahead of it by increasing my net worth.

There are five ways you can fight back to increase your net worth.

🚨Problem: Inflation Steals Your Purchasing Power

1. Everything Costs More

The dollar in your bank account is worth less today than it was one year or twenty years ago.

Your rising cost of living is everywhere: gas, groceries, rent, and healthcare.

Even the things you once enjoyed doing more regularly for fun, going out to eat or seeing a movie at the theater, have become more expensive.

2. Salaries Don't Keep Up With Inflation

Your paycheck never keeps up with rising costs.

Your three percent raise doesn't help when the yearly inflation rate is ten percent.

That means every year, your currency loses ten percent of its value. The money that you earn buys you less.

You need to find ways to earn more.

Employers are not going to pay you more.

Get out of your comfort zone. Find ways to make extra income to increase your net worth.

You'll continue to fall behind without a financial plan.

3. The Cost Of Living Crisis Is Real

Housing is your biggest expense. You pay rent. Or you pay a mortgage. Property taxes and insurance continue to skyrocket if you own your home.

Prices exploded over the past five years due to currency devaluation when the government printed money with the CARES and INFLATION Reduction Act. Both contributed to inflation, making living costs more expensive for you and me.

I live in a medium-sized town in Montana. The costs of housing have skyrocketed over the past five years.

The average rent costs now $1,500 a month. The average price of a house in my state is now $500,000.

Food prices continue to climb at the grocery stores. Beef has especially become more expensive. Eggs have gone up in price. Canned goods have become more expensive.

Medical bills are more costly. Insurance companies, from healthcare to cars, continue to increase their premiums.

There is no way to escape the rising inflation costs of working one job. Your boss giving you a 6% raise won't beat the inflation rate.

Related - The Truth You Need To Know Now About the 6% Trap

✅Solution: How to Grow Your Wealth Faster Than Inflation

1. Learn High-Paying Skills To Boost Your Income

A low-paying job won't cut it. Even mid-level paying jobs won't cut it.

The fastest way to grow your income is to learn skills that customers will pay you for.

The highest-paying skill is solving people's problems. You can do this as a consultant. Freelance. Walk dogs for people. You

You can start your own business today. Hiring a professional logo designer to make you a great logo for under $500 is easy. You can start an LLC for not much money in your state. You can offer services while working on making products and growing on a platform.

Areas that people pay for that you could build a long-term business in are:

Copywriting

Tech/AI/Cybersecurity/

Sales

Digital Marketing

Law

Trades (electricity, plumbers, HVAC, etc.)

You can combine a traditional business with an online business. You can sell products and services. You can generate revenue from advertisements and sponsors on YouTube and other platforms. You can charge for a premium newsletter on Substack.

2. Invest In The Stock Market To Beat Inflation

While saving money in a high-yield savings account is good, it still isn't enough to beat inflation.

You need to learn about the stock market.

The stock market allows you to grow your money by investing and holding company shares.

Start simple by investing in index funds. Invest in the S&P 500, emerging markets, and tech and energy. That gives you broad exposure to various companies in the stock market.

Buy shares in dividend stocks. These are companies that pay shareholders a quarterly dividend for owning stocks. Dividends are one way that you can make passive income.

You don't need a lot of money to start investing. Start small. Invest $50 to $100 a month. The sooner you start, the more you can see your money compound.

3. Invest In Real Estate For Long-Term Wealth

Real estate is an appreciating asset.

The real estate market goes up and down just like the stock market.

Real estate usually increases in value over time.

Real estate is a tangible asset, unlike cash.

Cash devalues from inflation and currency debasement.

REITs

Do you want to invest in real estate but can't afford to buy a property?

Invest in REITs. REITs stand for real estate investment trusts.

REITs are companies that own properties that allow you to invest in them. You can purchase a REIT stock or an index fund to start.

Start Small In Real Estate

If you can purchase a small house, you can rent a room on Airbnb or rent out the entire house as a landlord.

You can hire maintenance workers to deal with maintenance problems as they arise. Work to scale as a landlord. You can reinvest the money to buy another house or a small apartment complex. Ultimately, it depends upon your real estate goals.

Real estate regularly outperforms inflation. Real estate is another way to make passive income as a landlord from your renters.

4. Start A Side Hustle For Extra Cash

A full-time job is no longer enough.

With a side hustle, you can bring in an extra $500 to $2,000 a month

Direct that money towards paying off debt, covering bills, or investing.

Freelance on websites like Upwork and Fiverr.

Popular freelancing services include:

Accounting

Data Entry

Writing (articles, content, ghostwriting, and copywriting)

Graphic design

Video editing

You can do gig work. You can drive for Uber. You can deliver food for DoorDash. You can walk dogs on Rover.

People make six figures from walking dogs and providing other services full-time. There are more dogs than dog care businesses in many places. That means there is demand for dog and pet care services. Pet services are a boring business from which you can make six figures or money once you scale it.

A side hustle is a great way to get the first experience of working for yourself. You can earn money for your business if you've set up an LLC. from freelancing sites and gig jobs.

A business is your path to financial freedom.

5. Build A Business For True Financial Freedom

The wealthiest people are not employees. They own businesses that make money for them.

Businesses sell products. Businesses provide services. Businesses make money 24/7.

Starting a business is the fastest way to break out of living paycheck-to-paycheck.

You don't need a lot of money to begin today.

Start Small

Create a YouTube or TikTok channel. Write articles on a site that pays you to publish them. Provide services on platforms like Bark or Thumbtack.

You can hire freelancers or employees to work for you as you make more money. You can spend your time working to grow and scale the business.

I found a professional photographer in Seattle, Washington, who took photos for me to use for YouTube thumbnails. I used the photo as an author photo for my first book.

People use these platforms. They can be the launching pad to earn income for your business. At the same time, you can work on developing and providing a product or service to your target audience and customers.

😎Why Does This Matter?

Inflation will continue to make your life more difficult.

Your currency will continue to depreciate.

The cost of living will worsen due to currency debasement and inflation.

Learning to make money work for you is the only way to beat inflation.

The three best ways to increase your net worth are investing:

In real estate.

In the stock market.

In starting a business.

These are riskier than working a regular job. But because a job is safe, you'll never be able to make enough money to deal with the cost-of-living crisis.

Become comfortable taking calculated risks. Be willing to do what most people fear doing.

Why?

You'll have less competition. You'll be able to charge more for products and services. You become the one who controls the prices when you own a business.

Related - 5 Signs That You’re Fake Rich And How To Become Rich

🏁Summary

You can work to increase your net worth by:

Picking one high-income skill to continue to improve.

Opening an investment account so you can invest in the stock market.

Starting a side hustle to make it into a business.

The cost of living is not going to decline anytime soon.

It's up to you to increase your income and net worth.

Disclaimer: This content is for educational, entertainment, and informational purposes only. This is not financial, investment, or any advice. I write online about topics I find interesting. I make mistakes just like everyone else. Always consult a professional before making health, life, financial, investment, tax, or legal decisions.