The Big Mac Index Made Simple: Unraveling Purchasing Power And Currency Devaluation

Did you know that the price of a Big Mac is used to measure purchasing power? Here is the Big Mac Index made simple!

When was the last time you had a Big Mac? There are many ways to measure inflation. One method is known as the Big Mac Index. Here is how the Big Mac Index can measure purchasing power, inflation, and currency devaluation.

What Is The Origin Of The Big Mac Index?

The Economist is credited with creating the Big Mac Index in a 1986 survey, a unique index that uses a popular fast food item. The purpose of the Big Mac Index is to quantify the purchasing power parity (PPP) of countries' currencies around the globe. The Big Mac Index uses the McDonald's Big Mac price as the benchmark to measure a currency's purchasing power in different countries.

Purchasing Power Parity

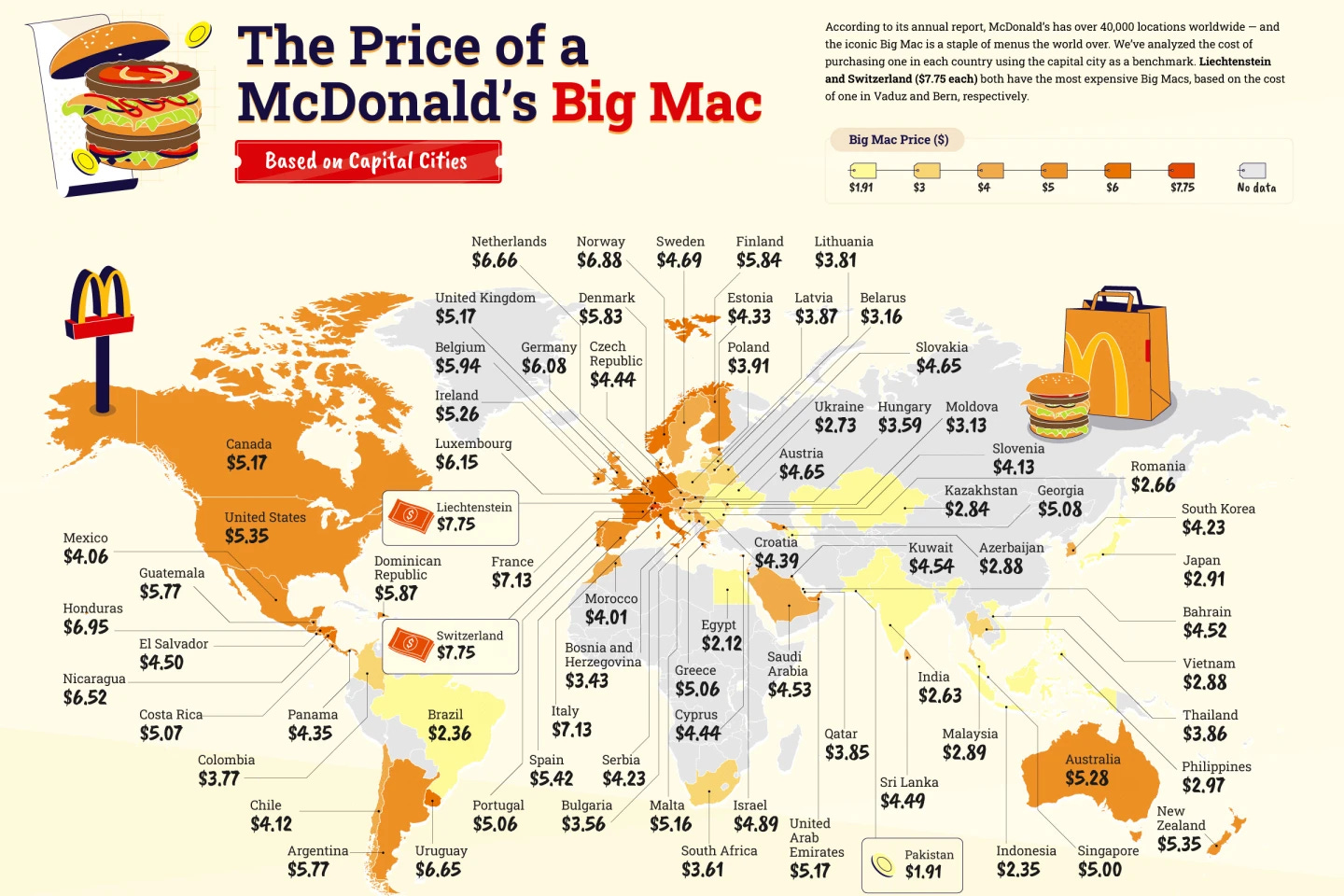

The Big Mac, a global culinary icon, is not confined to the borders of the United States. It is a worldwide sensation that is available in countries around the world. Each country's McDonald's menu offers unique items, making the Big Mac a global phenomenon you can find in any capital city worldwide.

An example of purchasing power parity would be if you are from the United States but purchase a Big Mac in Japan. A Big Mac costs $5.35 in the United States, while a Big Mac costs $2.91 in Japan (using the chart's numbers above).

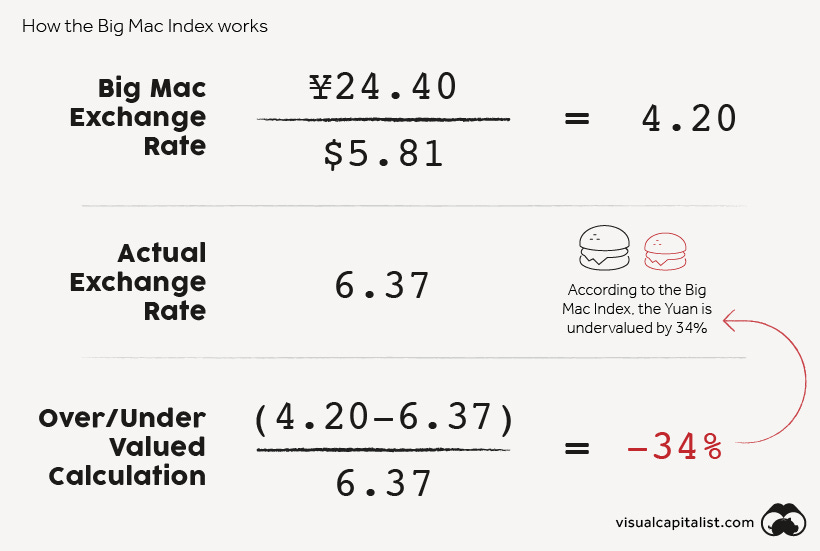

Visual Capitalist shows how the Big Mac Index demystifies the math behind purchasing power parity below.

Understanding purchasing power parity, a key economic concept, can be made simple using the Big Mac index. This index can help determine whether a currency is undervalued or overvalued. For instance, if the Big Mac index suggests that the Japanese yen is undervalued compared to the US dollar, you could consider investing in Japanese assets to take advantage of this undervaluation.

How Does The Big Mac Index Measure Inflation?

The Big Mac Index, a unique approach to measuring inflation, leverages the global operations of McDonald’s and the specific fixed and variable costs involved in the production of a Big Mac.

Everyday fixed business expenses include:

Electricity

Franchising

Accounting

Taxes

Rent

Common variable business expenses are:

Hourly minimum wage (labor)

Food costs (if the price of beef or another input product rises)

Transportation

Maintenance

Thanks to McDonald’s global brand recognition and the widespread production of the Big Mac, it serves as a benchmark for measuring inflation on a global scale. This enlightening concept allows you to compare purchasing power across different countries.

Rising Cost Of A Big Mac Over Time (Inflation)

Eat This, Not That broke down the rising cost of a Big Mac since it was first introduced. The prices are:

1960s - $0.45

1970s - $0.65

1980s - $1.86

1990s - $2.45

2000s - $2.24 - $3.21

2010s - $418 - $4.71

2020 - $5

2024 - $5.39 - $6.69

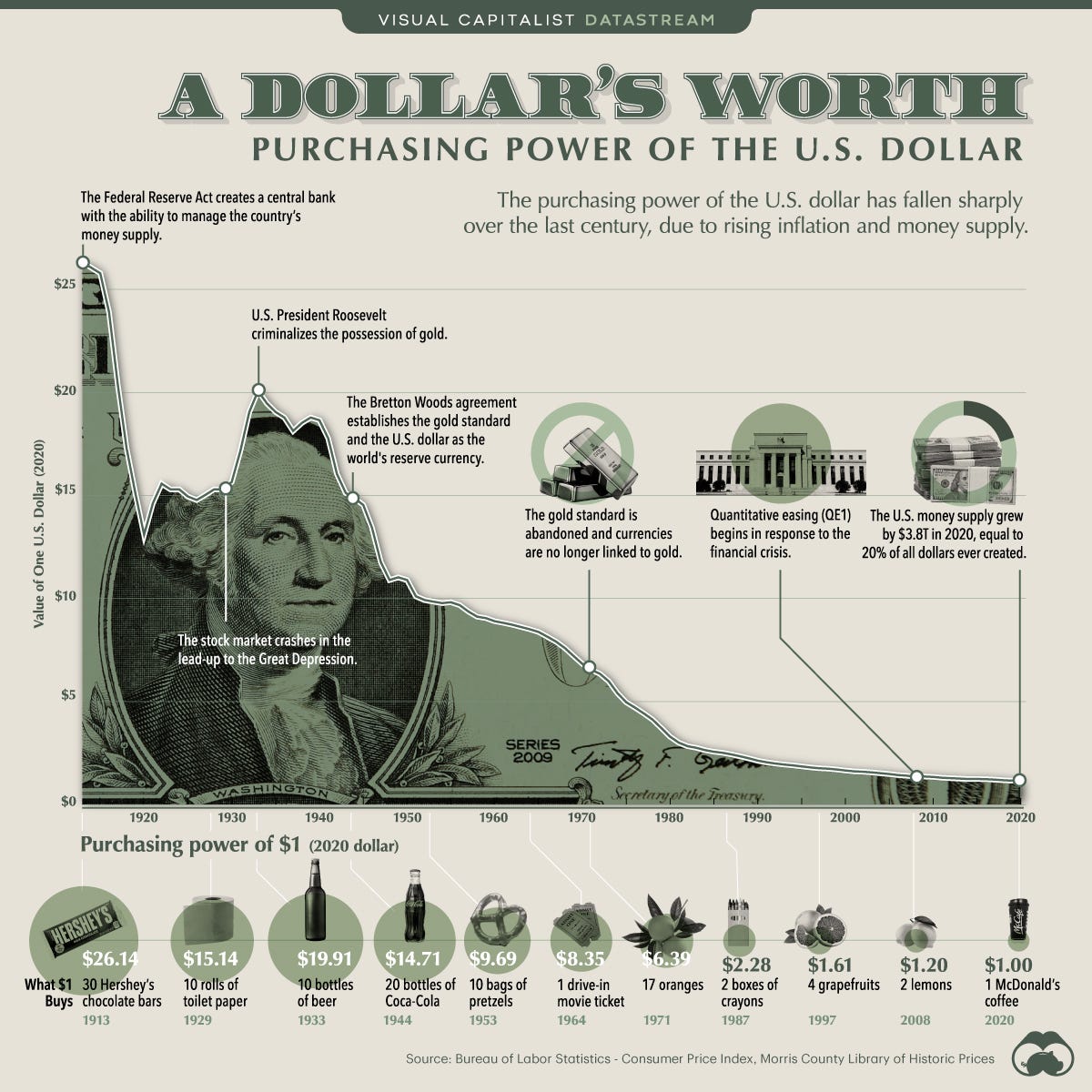

This continuous rise in price, from the 1960s to today, is a significant 15x increase for a single Big Mac. This consistent escalation in the cost of a Big Mac can be attributed to various economic factors such as inflation and rising minimum wage laws. It is also a stark reminder of the ongoing devaluation of your dollar.

Currency Devaluation

Currency devaluation, the erosion of your currency’s purchasing power over time, has a significant long-term impact. You must work more hours to earn the same dollar worth less today than 100 years ago. Currency devaluation is vital for your financial future.

The cost of a Big Mac, a familiar and relatable item, serves as a practical way to understand currency devaluation. In the 1960s, you could buy this sandwich for $0.45. Today, the same burger will cost you around $6, depending on your location, a stark illustration of how currency devaluation affects our everyday lives.

Think of currency devaluation as the water that seeps into a sponge. The sponge needs the water to expand, much like how inflation is more visible and easier to determine. However, the water expanding the sponge, representing currency devaluation, is more subtle, making it an intriguing concept to explore further.

As the cost of a McDonald’s Big Mac, groceries, and the cost of living continue to rise, it signals that your currency continues to be worth less. That means your currency, the dollar, continues to lose its purchasing power.

Limitations Of The Big Mac Index

The Big Mac Index is a valuable tool for comparing inflation. It provides a simple and relatable comparison to the numbers given by the Federal Reserve's Personal Consumption Expenditures (PCE).

Investors can use The Big Mac Index to help determine if a currency is undervalued or overvalued. It can be another tool when deciding to invest or trade in a foreign investment.

Some common criticisms of the Big Mac index are:

The index includes only the Big Mac. The index is simplistic compared to other economic metrics.

McDonald's does not have a location in every country in the world. While McDonald's does have locations worldwide, it is missing locations in other countries, particularly in Africa.

Despite the varying costs from country to country, The Big Mac Index remains adaptable. Understanding that fixed and variable costs differ in different locations around the world, investors can adjust their strategies accordingly.

Secure Single’s Algorithm recommends:

Summary

The Big Mac Index, a globally applicable tool, showcases the dollar's devaluation inflation and provides investors with another method to assess purchasing power parity in other countries. This Burgernomics approach allows you to measure the escalating cost of living by observing the price of a Big Mac in your area and comparing it to the Federal Reserve's PCE numbers.

Subscribe to Secure Single’s Substack for more content to chart your course toward confidence, happiness, and prosperity to thrive as a single person!

How can the Big Mac Index help you as an investor?

Order your copy of Thriving Solo: How to Flourish and Live Your Perfect Life (Without A Soulmate). It is now available in paperback and Kindle on Amazon.