The Power Of Creation: Why You Should Choose To Be A Producer, Not A Consumer

Are you a consumer or a producer? Here is why you should choose to be a producer, not a consumer.

When purchasing products or services from a store, company, or service provider, you are a consumer. While you cannot stop being a consumer since there are things you will always need to buy, you can become a producer. There are many benefits to being a producer.

Related :

The Problem With Being A Consumer

As a consumer, you purchase things that you want or need. You do not produce anything. Your lifestyle is based on consumption.

You are told that consuming is equal to happiness. That means that you must have the newest gadget. You must have the latest new clothes. You must keep up with other people, from your friends to people on social media.

You want to have whatever it may be that you want. You can put it on your credit card rather than waiting to buy it once you have the money. It is a simple and easy choice—instant gratification.

You get what you want but must now pay the high credit card interest rate. The current credit interest rates range from 18% APR to 30% APR. That is then debt that compounds each month.

Consuming beyond your means leads you to live in debt. According to debt.org, the average American debt ranges from roughly $10,000 to nearly $30,000.

Three Financial Lifestyle Choices

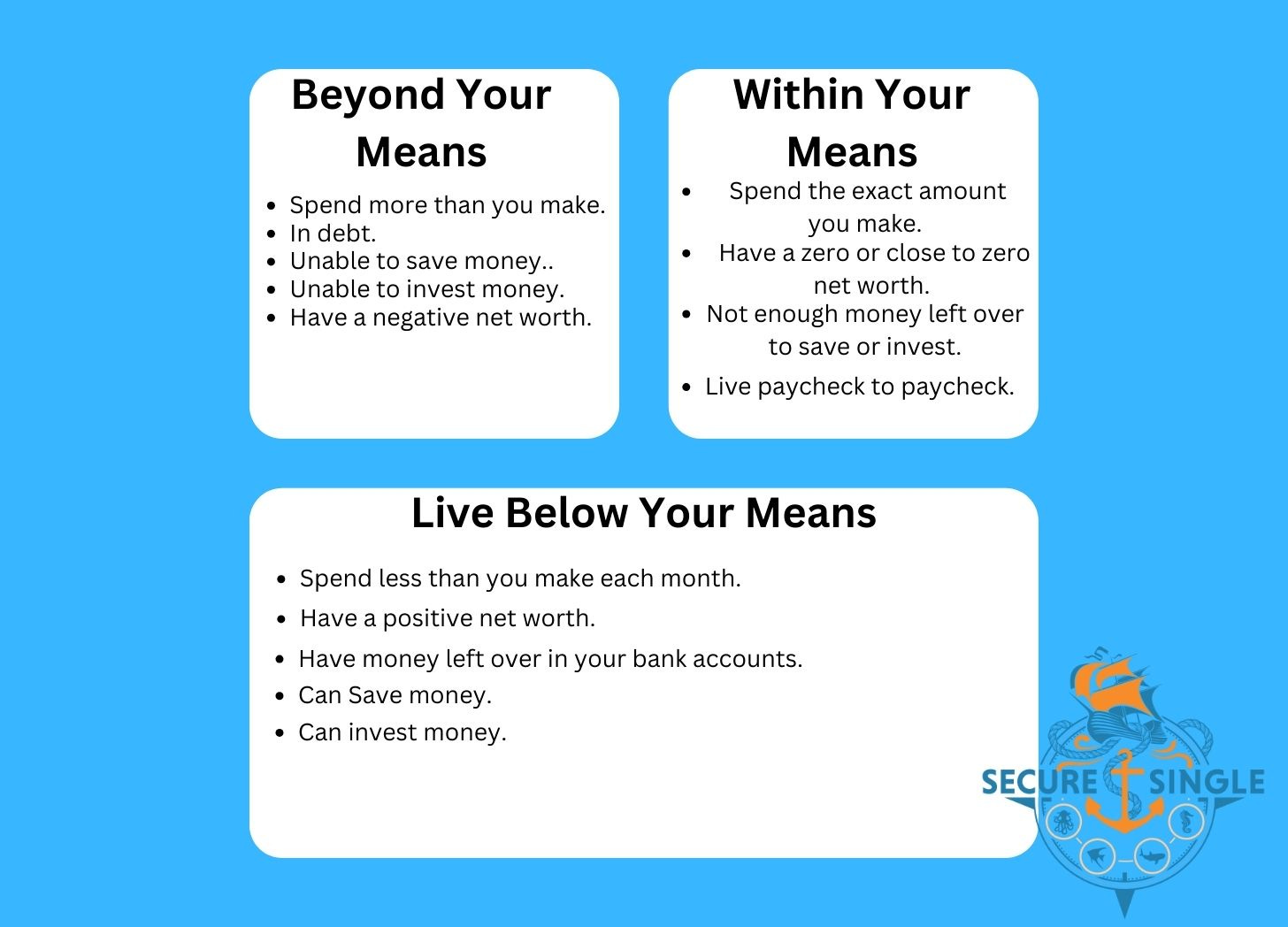

You live beyond your means when you spend more than you bring monthly. You live within your means when you spend the exact amount you make each month. You live below your means when you spend less than you make monthly.

As inflation and the cost of living worsen, you may find yourself stuck in a debt cycle. Five signs that you are in a cycle of debt include:

Debt is used to pay off another form of debt.

Your credit is taking a hit.

You find that you pay high interest charges.

You live paycheck to paycheck.

High debt-to-income ratio (DTI).

People Making Six Figures Are Struggling

Today, there are even people who are making six figures who are in debt. The global advisory firm Willis Towers Watson found that “18% of employees making more than $100,000 annually live paycheck to paycheck.” Other troubling indicators that Wilis Towers Watson discovered include:

Nearly 40% of employees do not have $3,000 available for an emergency.

The majority of employees are not saving enough for retirement.

The majority of employees believe that they are worse off compared to previous generations.

Consumerism Is A Trap

The point is that consumerism is a trap. Many people are never taught the basics of personal finance and managing money. Employees can get stuck in consumerism and a cycle of debt if they live beyond their means or don’t make enough to cover the basic living costs.

You can work to reduce the things that you consume by becoming a minimalist or through intentional living.

The best option is transitioning from being a consumer to becoming a producer.

Keep reading with a 7-day free trial

Subscribe to Secure Single by James Bollen to keep reading this post and get 7 days of free access to the full post archives.