The Shocking Truth About Young Americans' Low 401(k)s

Are you contributing enough to your 401(k)? Many young Americans 401(k) balances are dangerously low.

How is your financial health when it comes to contributing to a 401(K)? For many young Americnas, their 401(k)s are dangerously low.

The consequence of having a low 401(k) is that retiring will be more difficult. The transition from the traditional nine to five is being replaced by self-employment and working in the creator economy. The modern economy works differently. An aspect of the modern economy is that it is more difficult to find a traditional job that will provide benefits, including a 401(k).

Many Americans Are Behind Saving For Retirement

Many Americans are behind on saving for their retirement. According to Bankrate, a large percentage of Americans are not on track for their retirement savings goals, and one-third do not have any retirement account.

Ir gets worse. Icon states that 81 million Americans do not have a retirement plan.

401(k) Average Balance By Age Group

The average 401(k) balance is low for younger people. Financial Strategists report the average and average 401(k) balances below by age group using Vanguard’s 2023 data. They may appear good on the surface, but the numbers become bleaker once they are broken down to a particular age.

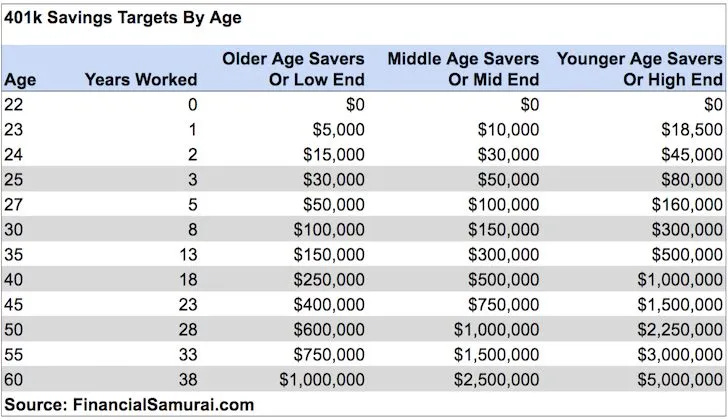

In contrast, Financial Samurai breaks down what the different 401(k) target goals should be by age and savers’ age.

The numbers that Financial Samurai has for targets are vastly different from the previous chart. They are more than double what is currently the 401(k) balance by age range. The narrower target with specific ages helps to better give people an idea of what numbers they should aim to contribute to with their 401(k).

It is clear that young people are behind in contributing to their 401(k). There are a variety of reasons why this is the case.

Why Do Young Americans’ Have Low 401(k)s?

Transition From Full-Time Jobs To Part-Time and Gig Jobs

Some jobs do not provide a 401(k):

Freelancing

Part-time jobs

Employers who do not provide them

As more companies transition from offering full-time jobs (with benefits) to more part-time and gig jobs, companies do not need to provide financial benefits to employees. A 401(k) has been a traditional financial benefit that employers would match.

Many part-time and gig jobs do not offer benefits. Most jobs I have worked have been random sales, merchandising, or gig jobs. The companies often did not provide a 401(k) or other financial benefits.

Employees must work a minimum number of hours weekly to receive certain benefits. The part-time jobs would max out hours for employees just below that number.

Keep reading with a 7-day free trial

Subscribe to Secure Single by James Bollen to keep reading this post and get 7 days of free access to the full post archives.