What Does America's Declining Influence Mean For Americans?

The United States' hegemony is being challenged. There are consequences that Americans will need to deal with as the United States declines as an empire.

There is starting to be more discussion around the prospect of America losing its status due to the BRICS, China, and China’s Belt And Road Initiative. The prospect of the United States losing its world reserve currency status is often put in the “fear-mongering” category despite the countries losing reserve currency throughout history once they lost dominance. It will not happen overnight, but to think the United States could never lose its place in the world is naive. It’s a matter of if, not when.

Recommended:

What Does America’s Declining Influence Mean For Americans?

In the short to medium term, Americans may be able to continue to enjoy their lifestyle of living in what is currently the dominating empire. Over the long term, that may change as countries continue to lose respect for America as a result of the societal decay and cultural problems that the country continues to deal with. There is then the increased incentive for countries to find a solution to become independent of the U.S. dollar.

Once the dollar loses its reserve currency status, that will affect the livelihood of Americans and what the United States government can do the most.

America’s Declining Influence

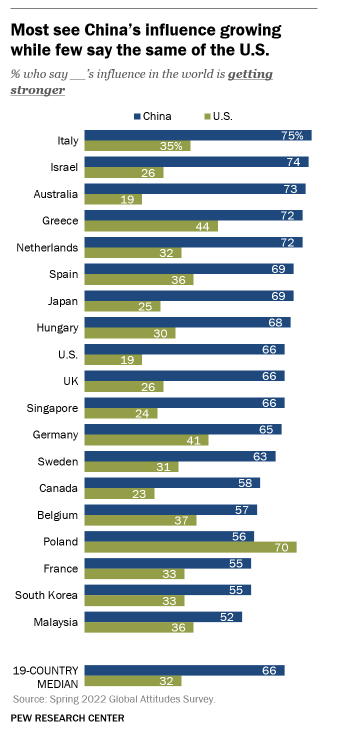

Pew Research has found that many countries when surveyed recognized China as having growing influence and the United States as having declining influence. Many of these countries are even allies of the United States. They may change their mind to back the growing stronger power instead of remaining loyal to the United States as an ally.

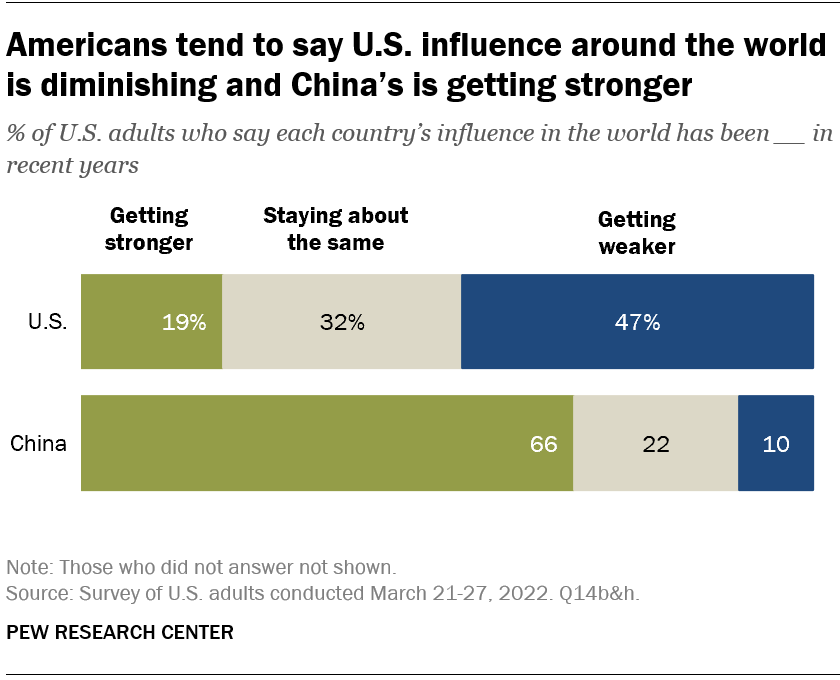

Pew Research has found that even Americans are starting to acknowledge that the United States’ influence is diminishing abroad.

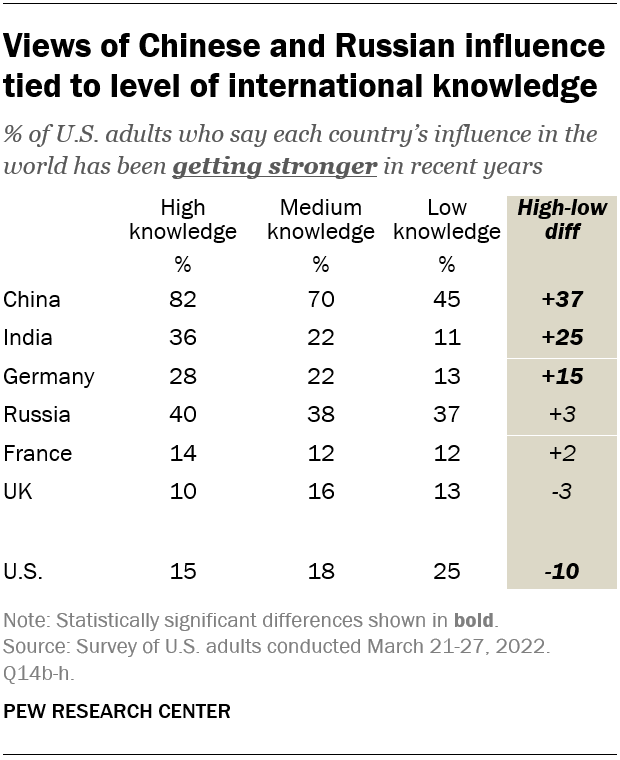

Further, Americans more aware of international events and geopolitics were more likely to be aware of China and Russia’s influence according to Pew Research.

As people begin to lose confidence in their government-issued currency, they begin to seek out alternatives to holding the devaluing currency along with rising inflation. This creates a problem that could lead to a crack-up boom. The Balance writes, “A crack-up boom is when there is significant credit expansion that results in rapid inflation, or hyperinflation, that leads to a collapse of the monetary system.” As more Americans become aware of the growing influence of the BRICS and China which directly challenges the dollar’s status, it increases the risk of Americans losing trust in their currency which will further help in the transition to a new financial system. What that system looks like is still unclear. It could be many currencies traded between countries (BRICS, Yuan, and lesser currencies) or a Central Bank Digital Currency (CBDC).

While the consensus view remains that the United States is the global power, the question is how long the US can maintain that when it continues to be challenged by other countries vying for its position. It is not a question of if. It is a question of when the official transition of power will transfer from the US to the BRICS and China.

The BRICS and China are explicitly challenging the United States by attempting to find a way to get around using the dollar, which is the world reserve currency. It will take time to find another currency or currencies to trade in to replace them, but it is not impossible.

Secure Single’s Algorithm recommends:

BRICS Challenging The United States

Another growing problem for the United States is the BRICS. These are countries of Brazil, Russia, India, China, and South Africa are working to connect a currency to commodities. Other countries have also shown interest in doing the BRICS.

Kitco reports, “The State Duma Deputy Chairman also suggested that the new currency would be backed by a basket of commodities, including gold and other rare-earth elements.”

If BRICS+ is successful, the currency will be backed by commodities. That means that it is a currency that is actually backed by something of value compared to a currency, such as a dollar, that is only backed up by confidence. One is real and tangible. The second is abstract and subject to the whims of the population. Which one would you rather have for your currency?

Keep reading with a 7-day free trial

Subscribe to Secure Single by James Bollen to keep reading this post and get 7 days of free access to the full post archives.