3 Reasons Why Millennials And Gen Z Are Moving Back In With Their Parents

Why are many Millennials and Gen Z having difficulty getting started? The three main causes are related to monetary issues.

Why are more Millennials and Generation Z living at home? The three reasons are dollar devaluation, rising real estate costs, and wage stagnation.

Millennials And Gen Z Are Moving Back Home With Their Parents

CBS News reports that more Millennials and Gen Z are moving back in with their parents. The reasons that CBS lists are:

To save money.

Unable to rent or purchase their own place.

Working to pay off any debts.

Recovering from an emergency financial cost.

Losing a job.

The Bloomberg Harris Poll found that “81% of respondents of any age agree that reaching financial security is more difficult today than it was 20 years ago. But 74% of those surveyed agree that younger Americans face a "broken economic situation that prevents them from being financially successful," the survey found.”

According to The Guardian, 51.5% of homeowners in 2022 were Millennials. The other half of Millennials and Gen Z have trouble affording a home. Some have decided to move back in with their parents.

Dollar Devaluation And Inflation

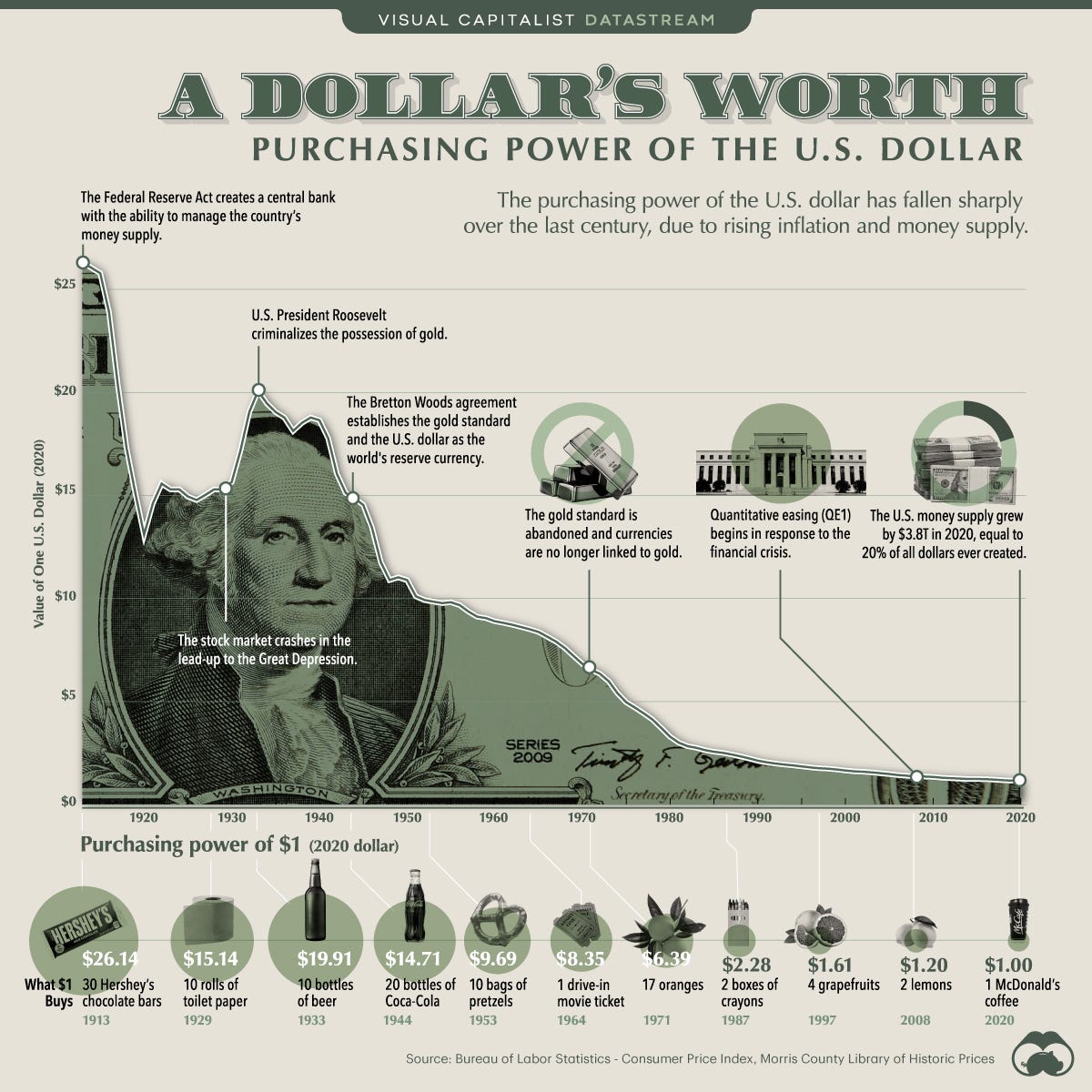

Central banks are responsible for devaluing the dollar by printing money. This is referred to as quantitive easing. Quantitative easing is an increase in the money supply. Lyn Alden provides more detail and nuance about quantitive easing here.

The devaluation of the currency affects wages, the cost of real estate, and your standard of living.

Related - The Reason Why Inflation Won’t Go Away In 2023

Rising Cost Of Real Estate

It is not so much that real estate's value has increased. It is more that the currency has continued to lose value. On the surface, people who own their homes or other real estate properties have made money from owning real estate.

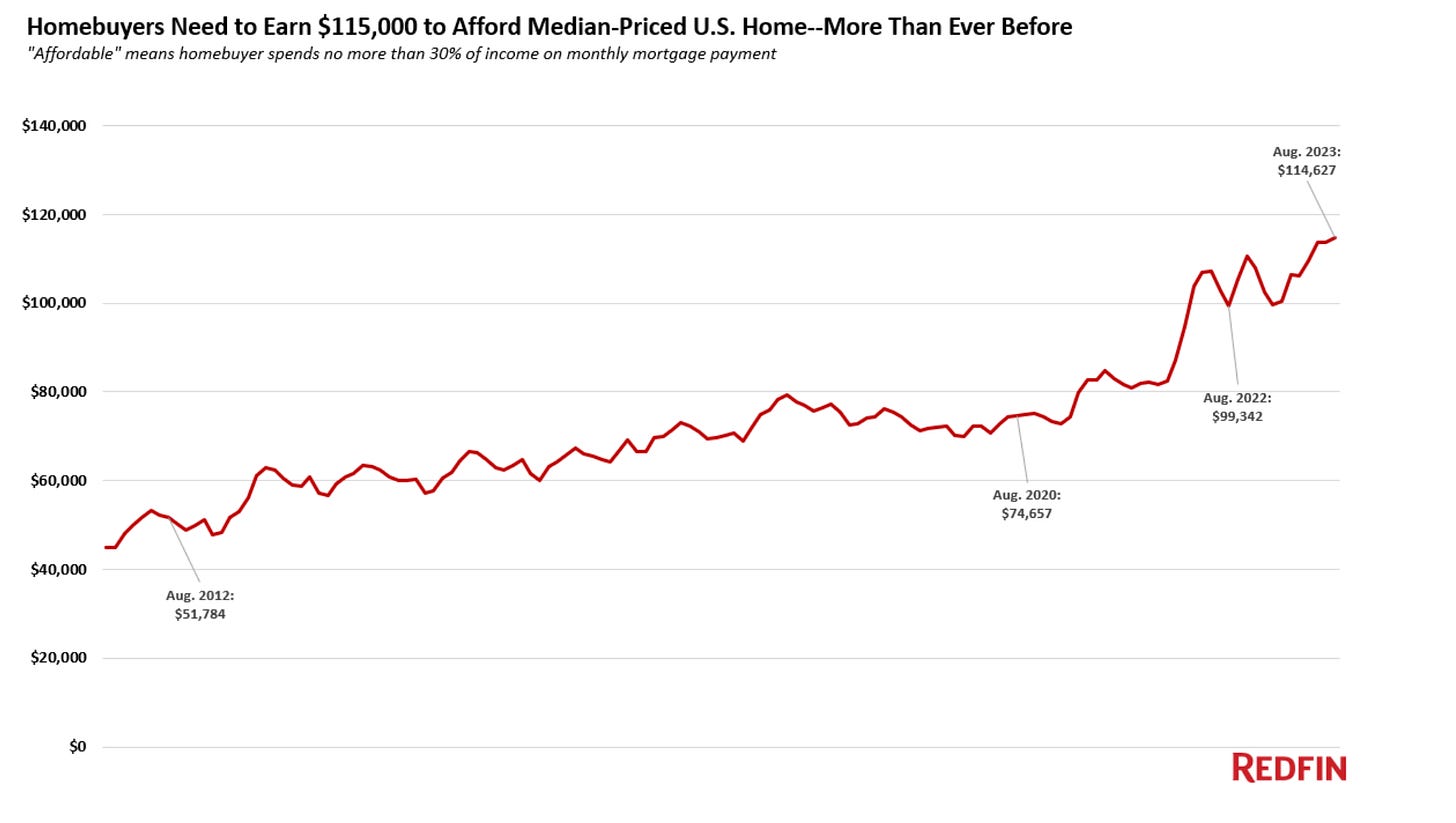

Redfin reports that the average homeowner must now make six figures to afford to purchase a home.

Here is a look at the cost of home prices for Baby Boomers compared to Millennials. The chart below Cutoday shows that the average home in 1970 priced at $23,900 saw an increase of an astonishing 1,608%!

Below is another chart that shows the cost of houses compared to inflation, using the Federal Reserve’s CPI data, which is suspect. You can see the problems with the Federal Reserve’s inflation numbers by simply going to the grocery store or looking at a price increase on any of your recent bills.

The median prices of housing have continued to rise. You can measure it in a percent increase or an overall inflation increase. Both methods demonstrate that housing, in which a person can afford to work a regular job and save, no longer works. You must be in at least the six-figure club to afford a house.

The Wage Stagnation Problem

There is then the problem of wage stagnation. Just because you may have received a raise does not mean you have more purchasing power. You are losing purchasing power as a consequence of inflation each year. Your wage would have to be increased yearly to keep up with inflation.

The charts below may be a little out of date when it comes to wage stagnation, but the principle remains the same. Your wages are likely not keeping up with the actual cost of living and the real inflation rate.

You can only expect your wages to increase so much as an employee. You can only be so productive for an employer as an employee. For this reason, you may be able to get a few raises from an employer. Or, you may try to work for another employer who will pay you more. The problem is you can only do that for so long until you reach the maximum you can earn in your field as an employee.

Demographic Implications

Due to wage stagnation and currency devaluation, people are staying single longer. Millennials and younger generations cannot afford a home. The implications of this affect many things that people seem to take for granted, from Social Security to having a sustainable population.

This makes sense. If you have difficulty paying your essential bills, from groceries to your credit card to your different types of insurance, you have difficulty covering your needs.

Some people may have experienced a failure to launch for whatever reason. But, the monetary policy adds to the difficulty of purchasing a large ticket item like a house.

Then, if you live with your parents (especially for men), that is unattractive because it shows that you have been unsuccessful in making something of yourself. That does not take into all the extra steps that must be done just to attempt to make something of oneself.

Why do you think more Millennials and Gen Z are moving back in with their parents? What do you think is the cause of this trend? What are solutions for those Millennials and Gen Z who want to get their own place eventually?

Solutions

You can find ways to increase your income.

You can consider looking at smaller houses instead of McMansions.

You can find ways to increase your skill set.

Consider going into business for yourself if you are in a field with limited upside potential or near the peak of what you can make in your career field.

Consider moving to a less expensive state or country.

Secure Single’s Algorithm recommends:

Mastering The Art Of Sales: The Power Of Grifting, Marketing, And Propaganda In Business

Self-Responsibility Crisis And Self-Ownership In Professional Life

Summary

The real estate market may or may not crash. The best thing you can do is to invest in yourself and find ways to increase your income if you want to one day purchase a house. If you work online, consider moving abroad.

Become A Secure Single.

There is another dynamic happening as well. There are a lot of Boomers who are struggling in this economy as well. Multi-generational living helps everyone.