5 Astonishing Lessons I Learned From My 3 Eye Surgeries

And why you need an emergency fund, HSA, and passive income.

Are you young, healthy, and think that medical emergencies only ever happen to "other people?"

I used to think the same way as you.

I then had three different eye surgeries over a decade. The eye surgeries limited my ability to enter the traditional workforce and gain work experience due to the pre- and post-surgery requirements.

Turns out, life doesn’t care what you think you're going to do. One day, you’re fine. Next, you’re staring at a $7,000 medical bill.

These are five astonishing lessons I learned from my three eye surgeries that will open your eyes to why you need an emergency fund, HSA, and passive income.

Lesson 1: Medical Emergencies Happen When You Least Expect Them

I began to notice that my vision was becoming blurry during the final semester of my senior year of college in Denver, Colorado. My vision went from fine to fading and then to blurry.

I went from being able to read the PowerPoint presentation at the back of the classroom to needing a vision assistance tool while sitting in the front row and working on my laptop on homework.

I finally saw an eye doctor. It turned out that I had a rare eye disease called keratoconus.

My parents had to fly down to Denver to help me drive around and take me to my eye surgery. My parents paid for my eye surgeries since I had just graduated from college and was trying to figure out what to do career-wise.

Start An Emergency Fund Now

You never know when you'll need it.

Start saving as much as you can each week.

Follow the upgraded 50/30/20 budget, which helps you to build an emergency fund faster.

Aim to have $1,000 first.

Why This Matters

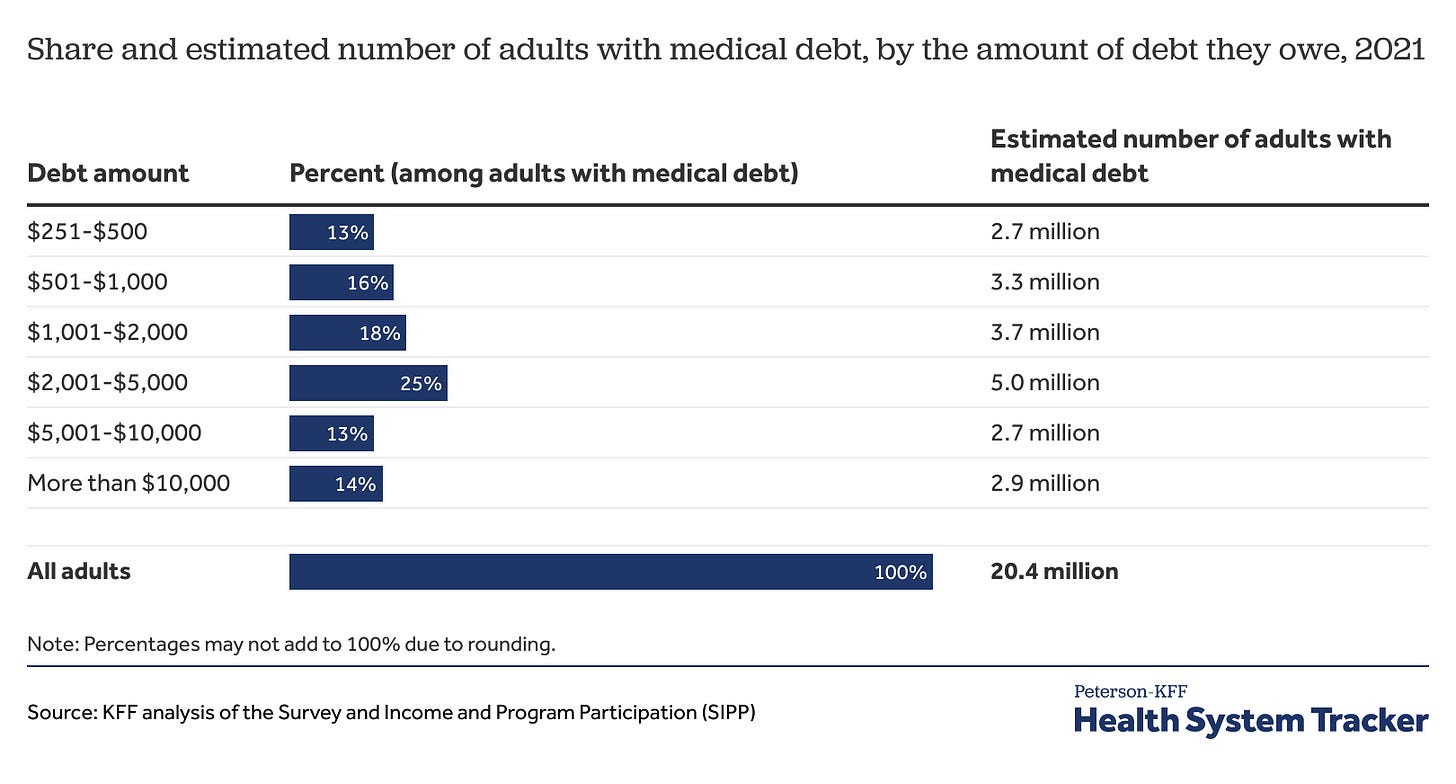

According to Health System Tracker:

"Most of the 20 million adults with medical debt owe over $1,000, and about half (11 million people) owe over $2,000."

Emergency savings can help you avoid medical debt.

Save as much money as possible for yourself to financially protect yourself in case of health problems.

You never know what type of medical emergency you may have.

Key Point: Bad luck doesn’t wait for your paycheck. Be prepared for when disasters strike.

Lesson 2: Eye Surgeries Are Expensive (And Recovery Takes Time)

The average cost of an eye surgery in the United States is $3,000 to $7,000 per eye.

The cost of an eye surgery varies depending on:

The medical facility.

The type of eye surgery.

Anesthesia.

Ophthalmologist's fees for the surgery.

The type of lens you're getting in your eye.

Pre- and post-operative care.

Post-surgery eye drops (I still use mine).

Secondary follow-up procedures.

New prescriptions.

Tax deductions.

What your health insurance plan does and doesn't cover.

Oh, and recovery? Depending on the type of eye surgery, your recovery time will range from a couple of weeks to over six months.

I couldn’t drive, work out, or even bend over without risking more damage for six months. I could only stay in bed and listen to Spotify and audiobooks.

Health Savings Account

Your brokerage firm can assist you in setting up an HSA.

An HSA allows you to save tax-free on medical expenses.

Having an HSA and an emergency fund will help you be better prepared to cover medical costs.

Why This Matters

Without emergency savings or an HSA, you're stuck putting the costs of surgeries and medical care on a credit card.

You'll be stuck paying interest on your medical bills for years to come.

Key Point: Medical bills can quickly wreak havoc on your finances; save tax-free with an HSA.

Lesson 3: You Can’t Work If Your Body Fails You

After my eye surgery, I was unable to go to the gym. I couldn't lift anything over twenty pounds. I couldn't look at screens for weeks. I could only listen to music and audiobooks.

I couldn't apply for a job. I couldn't work on my website. I could not spend any time on side hustles.

I had zero income for six months until I received my doctor's approval to exercise and return to work.

Passive Income Streams

The great news is that there are lots of ways for you to make passive income today.

You can earn advertising revenue from a YouTube channel. You can sell digital products on Gumroad. You can self-publish a book on Amazon.

You can invest in dividend-paying stocks. You invest in index funds and individual stocks.

Your goal?

Make your money work for you so that you have money you can use when you can't work.

Why This Matters

If you're living paycheck to paycheck, one major injury can destroy your life.

Passive income streams, an HSA, and an emergency fund provide financial protection.

Key Point: Your body will experience health problems, or you'll hurt it in some way that requires surgery. Earn money while you sleep.

Lesson 4: Debt Makes Recovery Even Harder

Debt and financial stress make your recovery even more complicated.

Instead of focusing on healing and recovering, you're stressing out over the medical bills.

Stress slows down your recovery. Stress makes everything worse. Stress could lead to complications after the surgery that make your medical condition worse and make your medical bills cost more.

Avoid Debt At All Costs

Avoid incurring medical debt whenever possible.

Save money in a high-yielding savings or money market account. You'll have it when you need it.

Negotiate your bills with your provider.

Use payment plans if necessary.

Never ignore your bills and payment plans.

Pay them on time. Have a plan to pay off your medical bills.

Why This Matters

Healing is critical. Healing after a major surgery or health event is hard enough already.

Debt collectors calling you will only make it more difficult.

Key Point: Debt adds stress. Financially prepare now so you can heal in peace later.

Lesson 5: Life Is Fragile

Just because you're young doesn't mean that you're invincible.

I've had a total of three eye surgeries between the ages of 25 and 32.

The same problem happened to my other eye. I had to get a cataract surgery and then a corneal transplant to deal with the keratoconus in my second eye.

Invest In Your Future

You never know what life will throw at you. It may not be an eye surgery, it may be a car accident or something else.

Develop in-demand and highly valuable skills to increase your income.

Save. Save in an HSA. Invest in the stock market.

Build a business that can run without you.

Get good insurance that will cover a larger portion of the costs associated with expensive surgeries.

It's better to be financially prepared and have your financial life in order, so you don't have to worry about medical debt.

Why This Matters

You'll never receive a warning before life smacks you down.

Prepare now or pay later.

Develop perseverance. Be prepared psychologically and financially for when life gets tough and costs you money you never planned to spend.

Key Point: Peace of mind from financial stress and medical debt is invaluable.

Related

Summary: Don’t Wait Until It’s Too Late

I was lucky that I had a family who came to help me and could cover the costs of the eye surgeries for me. I was just out of college. I had no job or income to pay for the surgeries myself.

It taught me about the importance of being financially prepared.

Prepare for unexpected medical costs by:

Opening a high-yield savings account for medical expenses.

Start an HSA.

Max out your retirement accounts.

Invest each week in the stock market.

Work to build passive income streams.

If you’re young and healthy, today is the best day to start financially preparing for your future.

Key Point: Emergencies happen. Financially prepare now or regret later.

Disclaimer: This content is for educational, entertainment, and informational purposes only. This is not business, financial, investment, or any advice. I write online about topics that interest me. I make mistakes just like everyone else. Always conduct your own research and consult a professional before making decisions regarding health, life, finances, investments, taxes, or legal matters.