Slide Insurance: A Fascinating Value Bet Or Really Risky?

Slide Insurance offers value investors an opportunity to get a high ROI. But is it too risky?

Slide Insurance Holdings (SLDE) has been getting some attention lately in the insurance industry.

Slide Insurance combines modern technology with insurance to make it easier for customers.

Insurance is a profitable industry, but it is also a high-risk industry to operate in.

Depending on your investing style, you'll either find Slide Insurance to be a fascinating value bet or a really risky investment.

What Is Slide Insurance's Business Model?

Slide Insurance is a property and casualty (P&C) insurance company. The company provides insurance coverage for homes, condos, landlords, and commercial real estate.

Slide Insurance specializes in high-risk areas. The company focuses on states like Florida. Hurricanes and big storms are common. These types of regions are more prone to damage from natural disasters.

Slide Insurance charges higher premiums to offset any potential losses. The company has to be extra cautious with its risk management to protect its profits. If too many natural disasters happen, the company's profits could suffer.

Key Point: Slide Insurance sells home and commercial coverage in states that frequently have natural disasters.

The Financial Health Of Slide Insurance

Market Valuation And Revenue

Slide Insurance has a market valuation of $2.2 billion. The company has a total market cap of $2.7 billion.

In 2024, Slide Insurance’s total revenue was $846.8 million. The company's quarterly revenue is $281.6 million.

Price-To-Earnings (P/E) Ratio

Slide Insurance’s P/E ratio is 2.05. The property and casualty insurance industry's average P/E ratio is 12.16.

Slide Insurance is undervalued compared to bigger-name insurance competitors. Its P/E ratio is well below the industry's average. Slide could make the company an interesting pick for value investors.

Current Share Price Versus Fair Value

Slide Insurance’s stock currently trades at around $22 a share. Stock Analysts estimate SLDE's fair value to be around $420 a share. The stock is currently undervalued by 95%.

The stock has significant room to grow if the market prices it correctly over the long term. If the company performs well, early investors at the current price could see great future gains.

Price-To-Sales Ratio

The company has a low P/S ratio of 0.24. The low P/S ratio signals that the stock market undervalues Slide. The average P/S ratio for the insurance industry that specializes in property and casualty is 1.7, and 2.46 for specialty insurance.

Slide Insurance provides insurance for property but also offers specialized coverage for natural disasters in Florida. In both areas, its P/S ratio of 0.24 indicates that the company is highly undervalued.

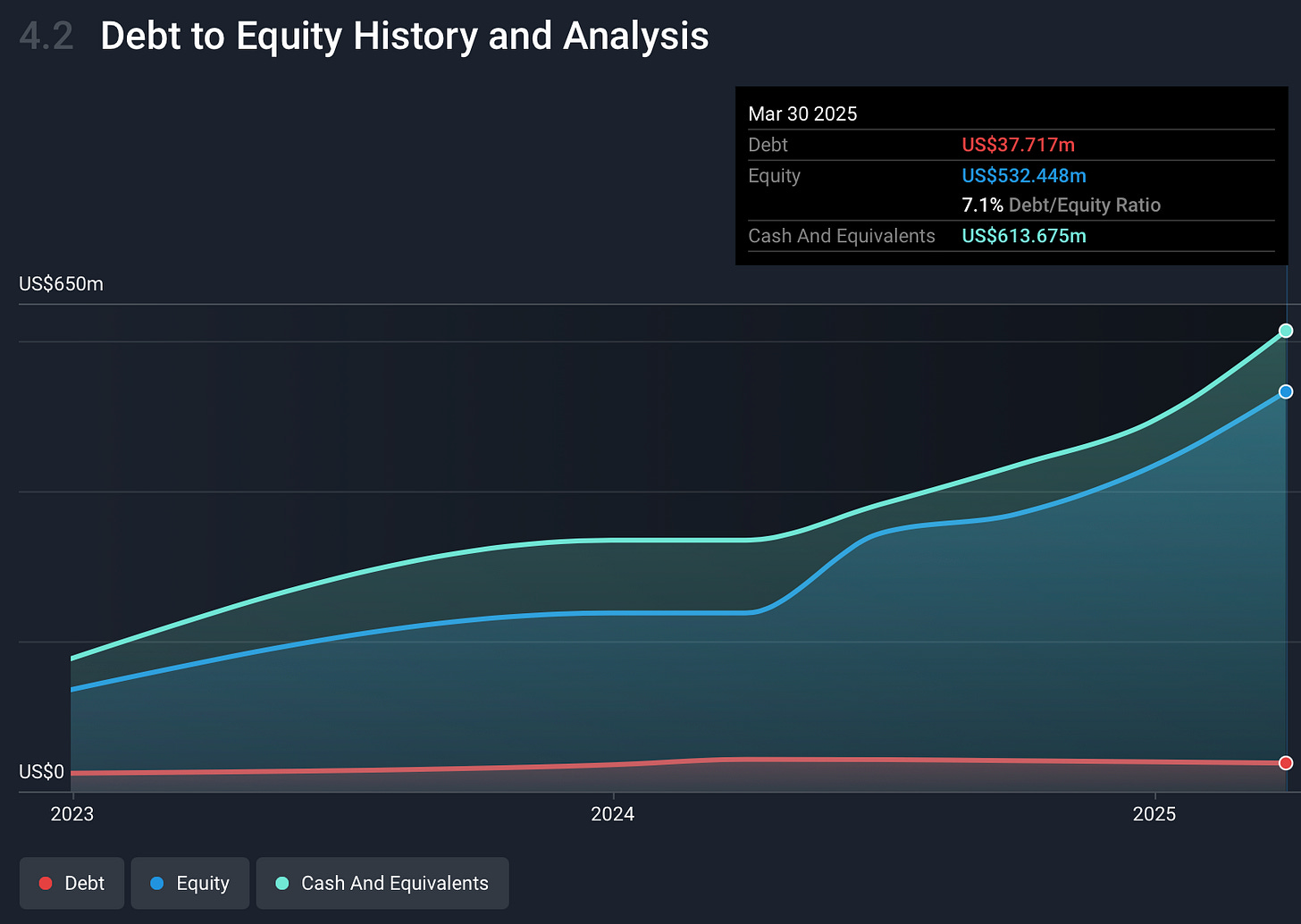

Debt-To-Equity Ratio

Slide Insurance has a debt ratio of 7.1%. The company has nearly $2 billion in total assets and liabilities. The company has just under $40 million in debt.

The company has $624 million in cash and equivalents to cover its debt and operating costs.

SLDE can cover the company's interest payments on its debt as well as its earnings before interest and tax (EBIT).

Dividend Yield

Some investors love stocks that pay dividends. Slide Insurance doesn't currently pay a dividend. You won't be able to earn passive income from this stock.

Key Point: Slide Insurance is financially solid, with low debt, decent growth prospects, and a highly undervalued stock price.

Bull Case: Why Slide Insurance Could Be a Great Investment

Undervalued Stock

The stock appears undervalued based on its P/E ratio and fair value estimates. If the market recognizes this and more investors enter the stock, the share price could rise.

As an early investor, you could generate a nice return. Slide Insurance’s focus on high-risk areas means the company can charge higher premiums. The higher premiums lead to stronger profits.

Low Debt

Slide Insurance has low debt levels. The company's low debt makes it more resilient during economic downturns. Slide will be able to adapt if the insurance market gets tough because it has minimal debt.

Growing Demand

The demand for property insurance in disaster-prone locations continues to grow. Slide has a long-term opportunity to expand.

Key Point: Slide could be a steal if it grows and continues to keep risks low.

Bear Case: Why Slide Insurance Is Really Risky

Risk Of High Payouts

Natural disasters are a threat to Slide Insurance’s business. If a major hurricane or wildfire strikes one of the company's key markets, Slide Insurance could have massive payouts. Those large payouts would cut deep into its profits. Unlike tech or retail businesses, insurers can’t just “sell more” to make up for losses. Insurers are at the mercy of weather and accidents.

No Dividends

Slide Insurance currently doesn’t pay dividends. Investors will rely entirely on the stock price growth for future returns. If the share price stagnates, there’s no backup income stream.

Competitive Industry

Competition is also a major concern. There are bigger insurance companies with more resources. The companies could squeeze Slide out of profitable markets.

Regulations

Government regulations and insurance laws may make it more challenging for Slide Insurance to operate profitably. The company must determine how to comply with various laws and regulations. That will require Slide Insurance to pay for lawyers and a legal team to deal with the rules and regulations.

Key Point: Slide could struggle if disasters hit or get squeezed out by more established insurance companies.

Related

Summary

If you like to find undervalued stocks with large growth potential and you’re comfortable with some risk, Slide could be a smart choice. The company has strong financials. Slide focuses on high-premium markets, which gives it a real upside. Insurance is a product that everyone needs.

If you're a dividend investor, Slide currently doesn't pay a dividend. Or, if you get nervous about unpredictable risks wiping out the company's profits, you'll want to look elsewhere.

Insurance stocks can be volatile. Slide doesn’t offer the stability of bigger, more established companies. However, if Slide does grow and reach its estimated market value of $420 per share, you could miss out.

It comes down to your investing strategy.

Key Point: Is Slide a promising value stock, or is it really risky?

Disclaimer: This content is for educational, entertainment, and informational purposes only. This is not business, financial, investment, or any advice. I write online about topics that interest me. I make mistakes just like everyone else. Always consult a professional before making health, life, finances, investments, taxes, or legal matters.

There is a reason why this company stock price appears to be cheap. Too many red flags here. Just have a look at their reviews and on comments on Seeking Alpha.