SM Energy: One Hidden, Profitable Company To Empower Your Portfolio

SM Energy (SM) is a promising energy and production (E&P) company to consider adding to your portfolio.

SM Energy (SM) is an independent, medium-sized oil and gas company.

If you're interested in investing in oil and gas, SM could be a company worth considering.

I'll break down SM Energy's business model, its worth, financial health, and the bull and bear arguments. You can then decide if SM Energy is worth adding to your portfolio.

What Does SM Energy Do?

SM Energ (SM) is a United States based exploration and production (E&P) company. SM Energy focuses on oil and natural gas.

Unlike major well-known names like Exxon or Chevron, SM Energy specializes solely in finding and extracting hydrocarbons. SM Energy primarily extracts oil and gas from two regions in Texas: the Midland Basin, Unita Basin, and South Texas. These areas are known for their rich reserves and cost-efficient drilling, making them prime locations for energy production.

SM Energy generates revenue from the sale of three primary products: crude oil, natural gas, and natural gas liquids (NGLs).

SM Energy employs a disciplined approach to drilling, using advanced technology to maximize output while keeping costs low.

The company employs hedging strategies, such as locking in prices for future production, to mitigate the impact of sudden price fluctuations in the oil and gas market. Hedging helps stabilize the company's cash flow even when energy markets get volatile.

Key Point: SM Energy is a lean, efficient operator that thrives in top-tier United States oil and gas fields.

How Much Is SM Energy Worth?

As of mid-2024, SM Energy has a market capitalization of around $3 billion. SM Energy is a mid-sized energy company in the oil and gas sector.

While SM Energy is not a giant in the industry, its company-focused operations enable strong profitability.

In 2024, the company generated approximately $2.57 billion in revenue, with a net income of $770.29 million.

SM Energy has profit margins of around 30%. The company had a profit margin of 36.05% in 2023, 29.92% in 2024, and 28.85% in 2025.

SM Energy's performance is closely linked to oil and gas prices. When energy prices are high, SM Energy's profits surge. Downturns can squeeze the company's margins. The company has access to prime drilling locations and cost controls. SM Energy has consistently delivered solid returns even in fluctuating markets.

Investors should closely monitor production growth rates and reserve replacement ratios. They will indicate whether the company is sustaining its resource base for long-term success.

First Quarter 2025 Results For SM Energy

SM Energy’s first-quarter 2025 results highlight robust production growth. The company has solid realized pricing across its critical operating areas.

The company’s successful integration of its Uinta Basin assets has driven total net production to the high end of guidance at 15.3 million barrels of oil equivalent (MMBoe), with oil accounting for 53% of total output.

A positive indicator of its high-margin production mix.

Net Production by Operating Area (Quarter 1, 2025)

Midland Basin

Delivered 81.5 MBoe, maintaining its position as SM Energy's largest and most efficient asset.

South Texas

Contributed 77.4 MBoe, with steady performance in both oil and gas.

Uinta Basin

Added 38.4 MBoe, exceeding expectations and proving to be a valuable addition to SM’s portfolio., exceeding expectations and proving to be a valuable addition to SM’s portfolio.

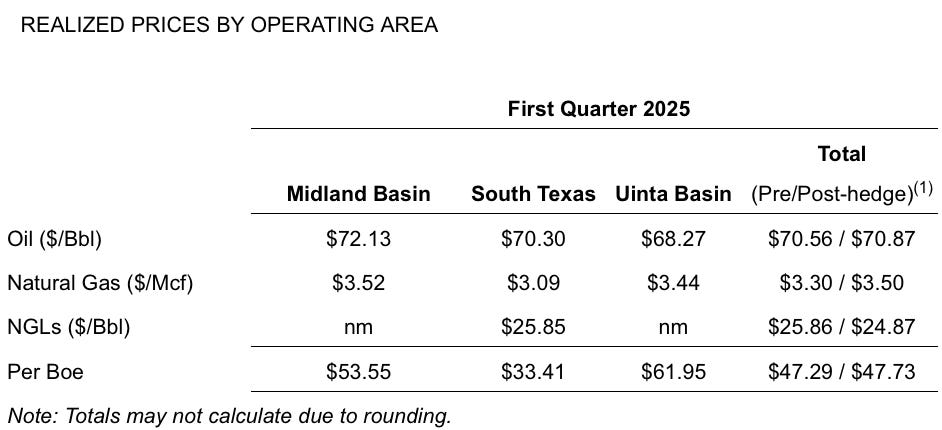

Realized Prices By Operating Area (Quarter 1, 2025)

Midland Basin

Achieved strong pricing with $72.13 per barrel of oil and $3.52 per Mcf of natural gas, benefiting from premium regional pricing.

South Texas

Posted $71.30 per barrel of oil and $3.09 per Mcf of natural gas, slightly lower than the Midland Basin due to regional differentials.

Uinta Basin

Realized $68.27 per barrel of oil, reflecting its growing contribution, with natural gas at $3.44 per Mcf.

Is SM Energy Financially Healthy?

Now, I'll examine critical financial metrics to help determine whether SM Energy is a wise investment.

1. P/E Ratio (Price-to-Earnings)

SM Energy’s P/E ratio is around 3.56. That's below the industry average of 12.83. A P/E ratio of 3.56 suggests that SM is undervalued relative to its earnings.

The stock market and investors are overlooking SM Energy’s potential. The stock market presents investors with a buying opportunity in SM Energy.

You should also check whether this discount is due to underlying risks, such as declining production or rising costs.

2. Share Price Versus Fair Value

Analysts estimate SM Energy’s fair value to be $60 per share. The company currently trades at around $25 a share.

If this assessment is accurate, the stock has upside potential and could triple in value.

3. PEG Ratio

SM Energy currently has a PEG ratio of 0.64. SM Energy appears undervalued relative to the company's growth prospects.

The average PEG for the oil and gas production industry is 5.94.

SM Energy's low PEG makes the company an intriguing pick for growth-oriented investors.

4. Debt-to-Equity (D/E) Ratio

The company currently has a D/E ratio of 0.63.

The company is actively paying down its debt. By focusing on paying its debt, SM Energy strengthens its financial position. The company is reducing risk for investors.

Lower debt means greater flexibility to weather industry downturns or invest in new projects to drive revenue growth.

5. Forward Dividend And Yield

SM Energy currently has a yield of 3.2%. The company pays a $0.80 dividend with an 11.20% dividend payout. SM Energy has consistently paid and increased its dividend over four years.

The company has a low dividend payout since it reinvests its profits into growth initiatives, debt reduction, and share buybacks.

If you're an income-focused investor, this may seem like a downside, but this strategy allows SM Energy to achieve greater long-term capital appreciation.

Key Point: SM Energy’s financials are strong with a low valuation, manageable debt, and solid growth potential, making it an appealing stock for value investors

Bull Case: Why SM Energy Could Go Up

Bulls see several reasons why SM Energy is a winning investment.

Oil Prices

Rising oil prices directly benefit SM’s bottom line. If global demand remains strong or supply tightens, SM’s profits could climb even higher.

Drilling Locations

SM Energy operates in premium drilling locations. The Midland Basin, Unita Basin, and South Texas are among the most productive oil fields in the United States. Drilling in these oil fields guarantees high output at competitive costs.

Financial Discipline

SM Energy demonstrates financial discipline. The company has cut its debt. The company is optimizing operations to boost its margins.

Low Valuation

The stock’s low valuation multiples (P/E and PEG) suggest it’s trading below its true market value. If market and value investors recognize this opportunity, the share price could increase.

Hedging Strategy

SM Energy's hedging strategy provides financial stability. Hedging shields the company from extreme price volatility. Hedging protects the company's profits and makes it a better investment for investors.

Key Point: SM Energy has substantial upside potential as long as oil prices stay high and the market rewards its financial discipline.

Bear Case: Why SM Energy Could Go Down

Skeptics highlight some risks that investors should be aware of with SM Energy.

Oil Prices

Falling oil prices are a concern. If oil demand weakens or supply surges, it would impact SM Energy's revenue and profit.

Environmental And Regulatory Pressures

Another issue is the risk of increased environmental and regulatory pressures. Stricter regulations around emissions rules or drilling restrictions could increase costs and limit production growth.

Competition

SM Energy is a minor player in a field dominated by larger oil and gas companies with deep pockets and strong connections. These bigger companies could outmaneuver SM ENergy in acquiring prime drilling sites.

Low Dividend

SM Energy currently pays a small dividend. The paltry dividend may deter income-focused investors. Dividend investors prefer knowing that they'll receive a consistent dividend over capital gains.

Debt

SM Energy has reduced its debt. The company is not debt-free. The company still has to pay interest on expenses that decrease its overall revenue and profit.

Key Point: SM Energy faces risks from oil price fluctuations, regulations, and competition, which put pressure on the stock in the stock market.

Related

Summary

SM Energy presents a compelling opportunity for investors who believe in:

The long-term strength of oil and gas demand.

Well-managed, low-cost energy producers.

Undervalued stocks with room to grow.

If you’re a cautious investor and you worry about commodity price volatility or prefer steady dividend-paying stocks, SM Energy is not a great fit.

Key Point: SM Energy is a financially sound, undervalued energy stock that's worth considering if you’re bullish on oil and gas.

What’s Your Take?

Do you think SM Energy (SM) is a buy, hold, or sell? Let me know in the comments below!

Disclaimer: This content is for educational, entertainment, and informational purposes only. This is not business, financial, investment, or any advice. I write online about topics that interest me. I make mistakes just like everyone else. Always conduct your own research and consult a professional before making decisions regarding health, life, finances, investments, taxes, or legal matters.