The Truth About America's Disappearing Middle Class

America's middle class is disappearing due to wage stagnation, inflation, currency debasement, and the cost-of-living crisis.

Did you know that America's middle class is disappearing?

The middle class was once a symbol of financial stability and the American dream: a house, a car, savings, investments, and financial security. It is now more challenging than ever to join the middle class due to inflation, currency debasement, stagnant wages, the cost of living crisis, and rising debt that erodes the middle class.

If you’re working hard but still living paycheck to paycheck, you’re not alone. You’re also not truly middle class.

Discover the truth about America's disappearing middle class and how you can work to build wealth to move up the middle class and higher.

Problem: Why You’re Not as Middle Class as You Think

1. Inflation Is Destroying Your Buying Power

Inflation isn’t just about higher prices. Inflation means your money loses value. Higher prices reflect currency debasement.

Over the past two decades, essentials such as housing, healthcare, and education have skyrocketed in cost. Your wages have barely budged.

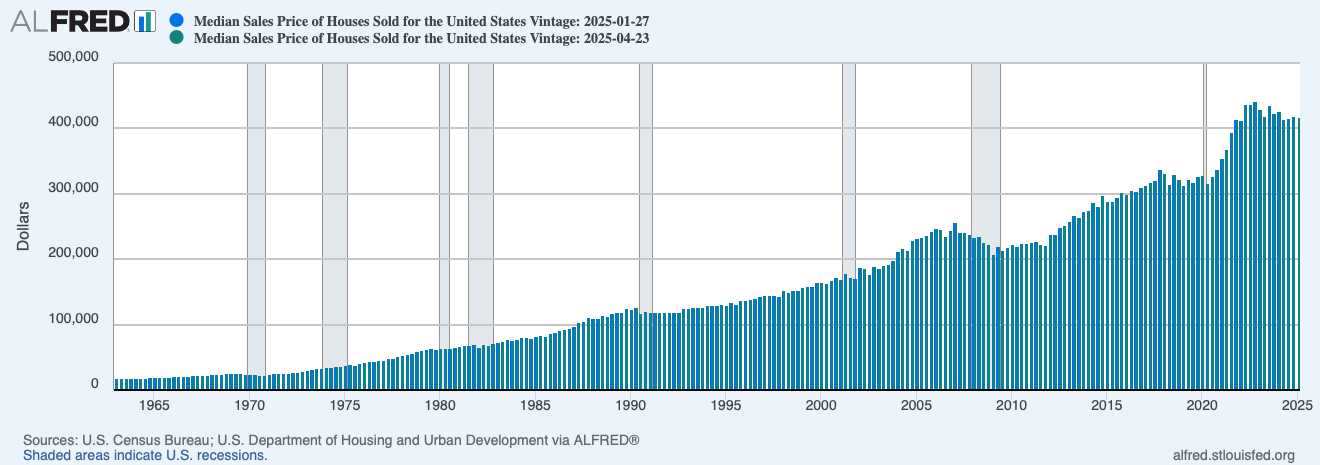

Housing

The median home price in the United States was $165,000.

Today? It's over $400,000.

Even if your salary has increased, inflation means you’re still worse off than before.

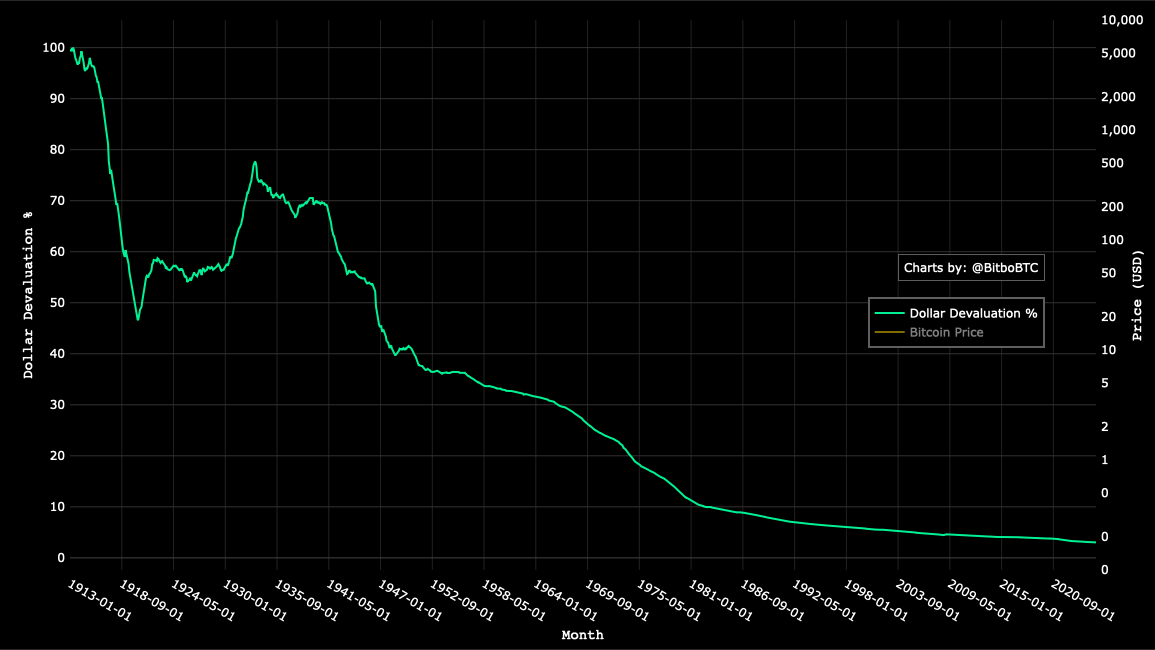

2. The Dollar Is Being Devalued (Currency Debasement)

The Federal Reserve prints money to stimulate the economy. Quantitative Easing, commonly referred to as money printing, is a hidden tax. Quantitative easing results in currency debasement.

More dollars in circulation mean each dollar is worth less. When your dollar is worth less, you need more to purchase the same amount of goods, services, and assets.

Currency Debasement

The United States dollar has lost 96% of its value since 1913.

The Federal Reserve is responsible for currency debasement through its quantitative easing (QE) policy.

Zero Interest Rate Policy (ZIRP)

When your savings accounts pay near-zero interest. Your cash loses value at a rapid rate every year.

When inflation exceeds the interest rate on your savings account, you are earning negative interest and losing money.

If you’re not investing in the stock market and in appreciating assets, you’re falling behind.

3. The Cost Of Living Crisis Is Squeezing You Dry

At one time, one income could support a family.

Today, many dual-income households struggle to pay the monthly bills.

You're being squeezed dry by inflation, currency debasement, and a rising cost of living from all sides.

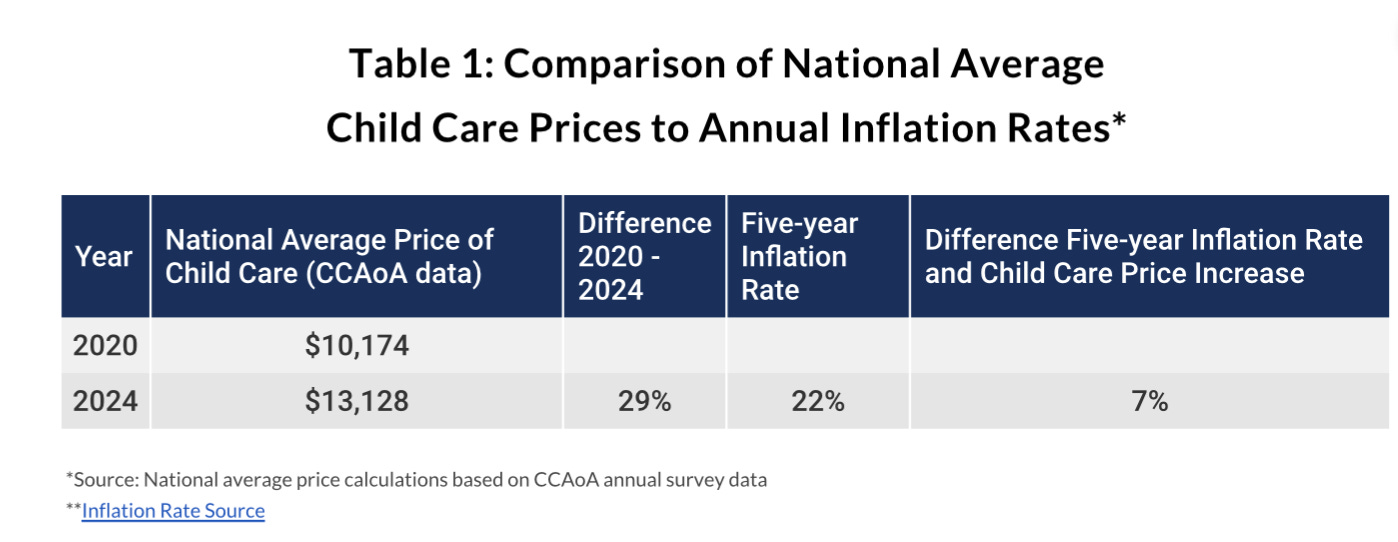

Rising Childcare Costs

Child Care Aware writes:

"The five-year increase in child care prices from 2020 to 2024 is 29%. Over the same five-year period, overall prices rose by 22%, meaning child care prices grew by 7% more."

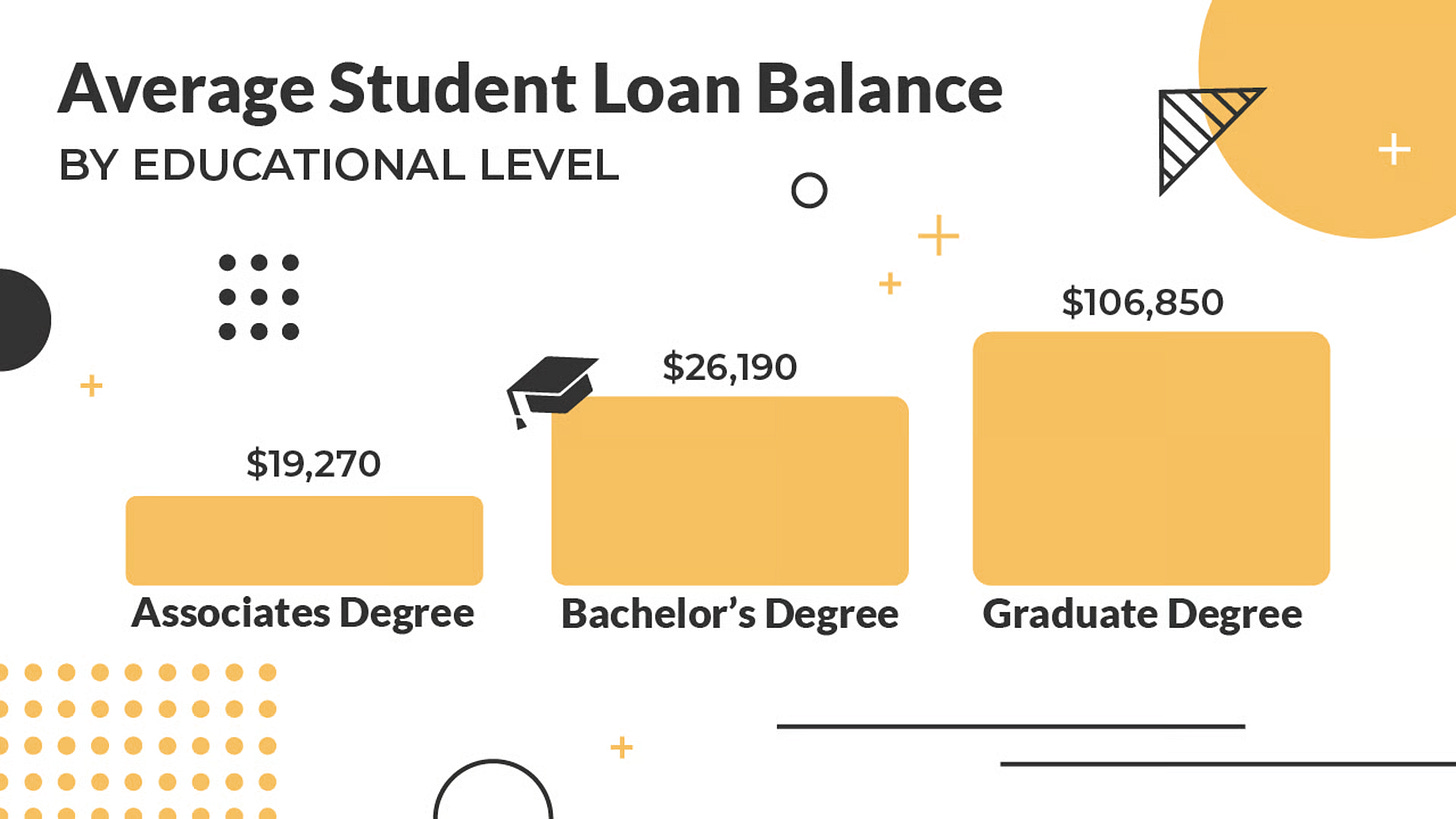

Student Loan Debt

College After Math writes:

"Costs for a college education have increased by more than 200% in the twenty-first century, with an average yearly increase of 8%."

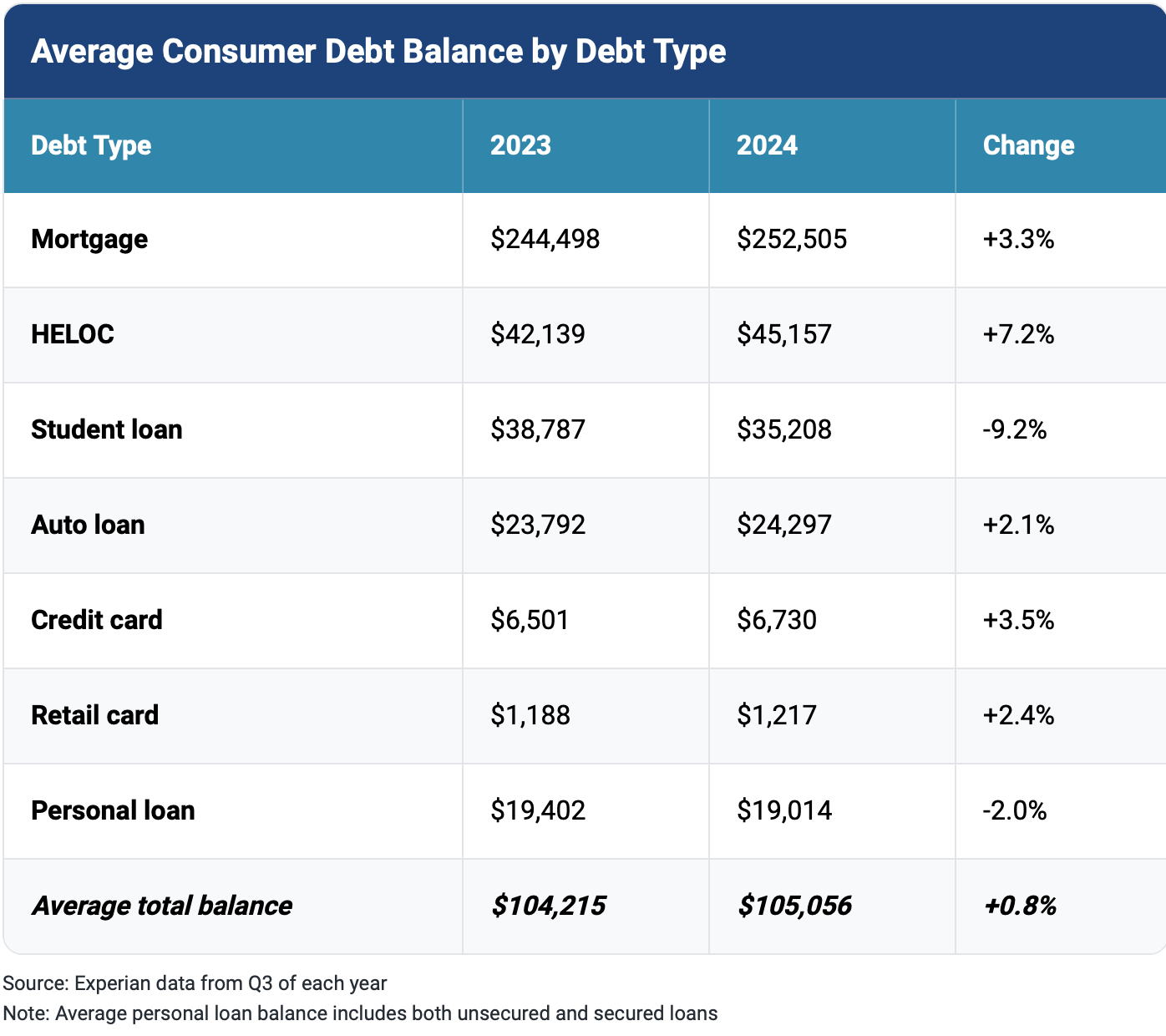

According to the College Investor, the average student loan debt is $37,088.

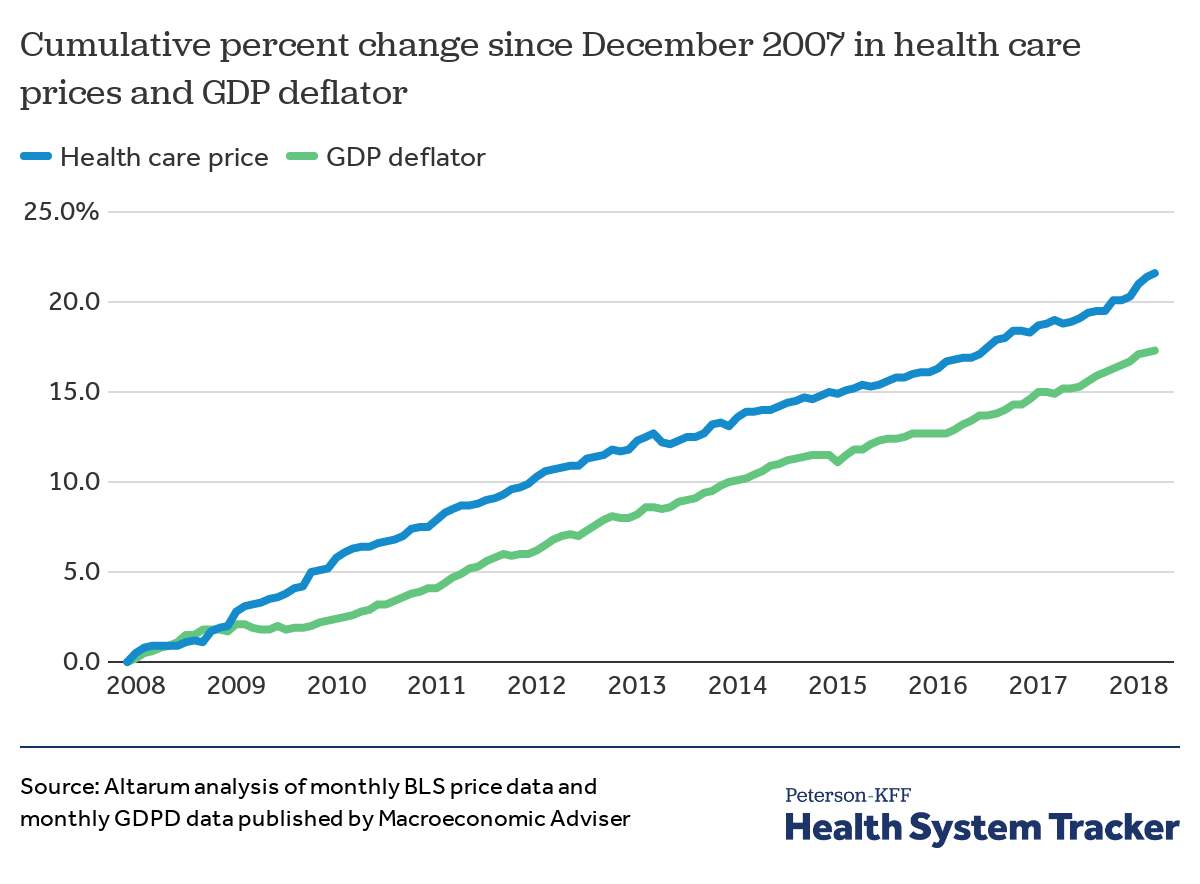

Healthcare Expenses

The cost of healthcare quickly consumes your income and savings, from health insurance to regular doctor visits. If you have any major surgeries or health problems, you'll pay even more.

The Health System Tracker indicates that the price of healthcare has increased by 21.6% since 2007.

4. Debt Is Keeping You Trapped In A False Middle Class

According to Experian, the average American consumer has $105,056 in debt. Consumer debt includes mortgages, credit cards, student loans, and car payments.

If you’re carrying high-interest debt, you’re not building wealth. You’re treading water. The fastest way to build wealth is to be debt-free.

Fake Middle Class

Many Americans feel middle-class because they can afford some modern luxuries, such as a smartphone, Netflix, and internet access. Many live a middle-class lifestyle even though they're in debt and are one emergency away from financial ruin.

Key Point: Inflation, a weakening dollar, rising costs, and debt have made the middle class a mirage for millions of Americans.

Solution: How To Build Real Middle-Class Wealth

1. Take Control With A Zero-Based Budget

A budget isn’t restrictive. A budget gives you freedom.

Know where every cent that you spend goes.

Zero-Based Budgeting

Every cent you earn needs a job.

Direct every penny towards your necessities, paying off debt, building savings, investing in the stock market, and for fun.

Eliminate The Financial Fat

Cancel your unused subscriptions.

Cook at home instead of always going out to eat.

Negotiate your biggest bills with companies that you struggle to pay each month.

Automate Savings

Pay yourself first every time you receive a paycheck. Set up your checking account to automatically send $100 to your savings account.

You can take this one step further. See if your employer allows you to send a percentage of each paycheck to two different bank accounts. You could then send a percentage of your paycheck to your checking account. You can then direct a percentage to a high-yielding money market or savings account.

Key Point: If you spend $5 less per day on impulse purchases, that’s an extra $1,825 saved per year.

2. Crush Debt Like Your Financial Life Depends on It (Because It Does)

Debt is your biggest obstacle to building wealth.

Aggressively attack any debt you have. Make it a goal to become debt-free.

Debt Avalanche Method

Pay off the debt with the highest interest rate first.

You can save the most money in the long term by using the debt avalanche method.

Debt Snowball Method

Pay your smallest debts first.

The debt snowball method is a quick and easy way to build momentum. Y

ou quickly receive positive feedback that builds confidence in your ability to pay off your debt.

Refinance High-Interest Loans

Consider refinancing loans with high-interest rates at lower rates. Lower rates mean faster payoffs.

If a company that you owe loans to knows that you're working to pay off your debt, they may be willing to work with you so you can get a lower rate.

Pro Tip: Pause any non-essential spending until your high-interest debt is gone.

3. Invest In Assets That Outpace Inflation

Cash and savings lose value. They do not beat the real rate of inflation. Invest in assets that grow wealth.

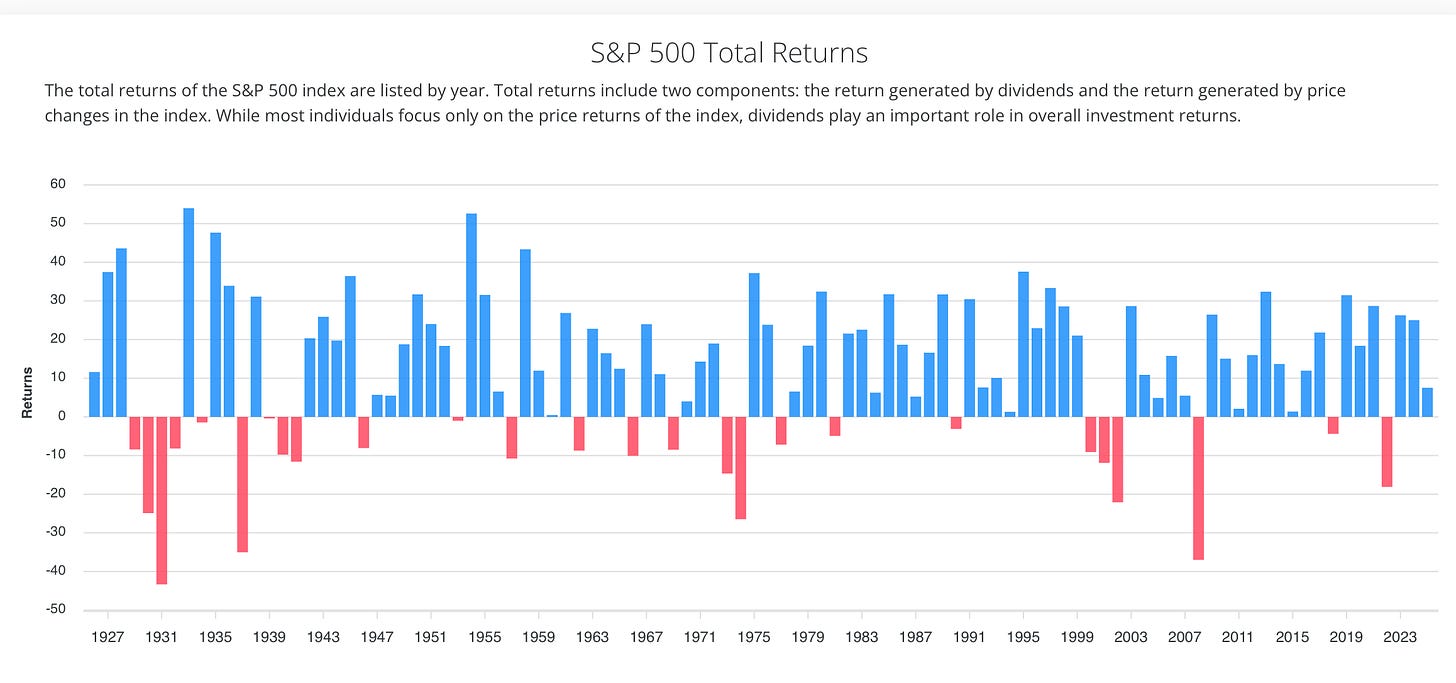

Index funds

Index funds are a straightforward way to begin investing in the stock market. Index funds allow you to invest in a whole sector of the stock market rather than purchasing individual stocks.

The S&P 500 has historically returned 10% annually. The S&P 500 has also returned 7% after accounting for inflation.

Individual Stocks

Outperform index funds. Index funds require you to do proper research, understand the fundamentals of what to look for in the stock market, and invest in the right companies.

Start A Business

A business is the best way to escape your part-time jobs or a 9-to-5.

You can be a self-employed business owner. Or you can grow and scale a company to get your time back by hiring freelancers and employees. You grow a business by selling products and services that customers need.

Real Estate

Rental properties are another option for you to start generating passive income.

Buy a small house that you can rent out each month to recoup your investment. Rent out on Airbnb until you can find long-term renters. As you earn more money from real estate, you can scale by purchasing larger properties. You can then build a time around you.

Yourself

Continue to educate yourself. Learn high-income skills like business, coding, digital marketing, finance, sales, and the trades. Continue to hone and learn skills that complement each other.

Key Point: Investing $300 per month at an 8% return yields $447,000 in 30 years.

4. Increase Your Income (Because Cutting Costs Alone Isn’t Enough)

The cost of living is not getting any cheaper. Inflation is not going away. You need to find ways to increase your income.

Side Hustles

Start freelancing on sites like Upwork and Fiverr. Drive for Uber. Deliver food for DoorDash. Tutor online.

Career Jumps

Switch companies to earn higher pay. Make a career change to a new field that aligns with your skills and experience to earn more. Start an online business.

Upskill

Study for certifications or degrees in high-paying and in-demand fields.

For example, I’m currently studying for a financial education certification to be certified to teach financial education, since there is a financial illiteracy epidemic. The certification will also give me more credibility with my subscribers and audience.

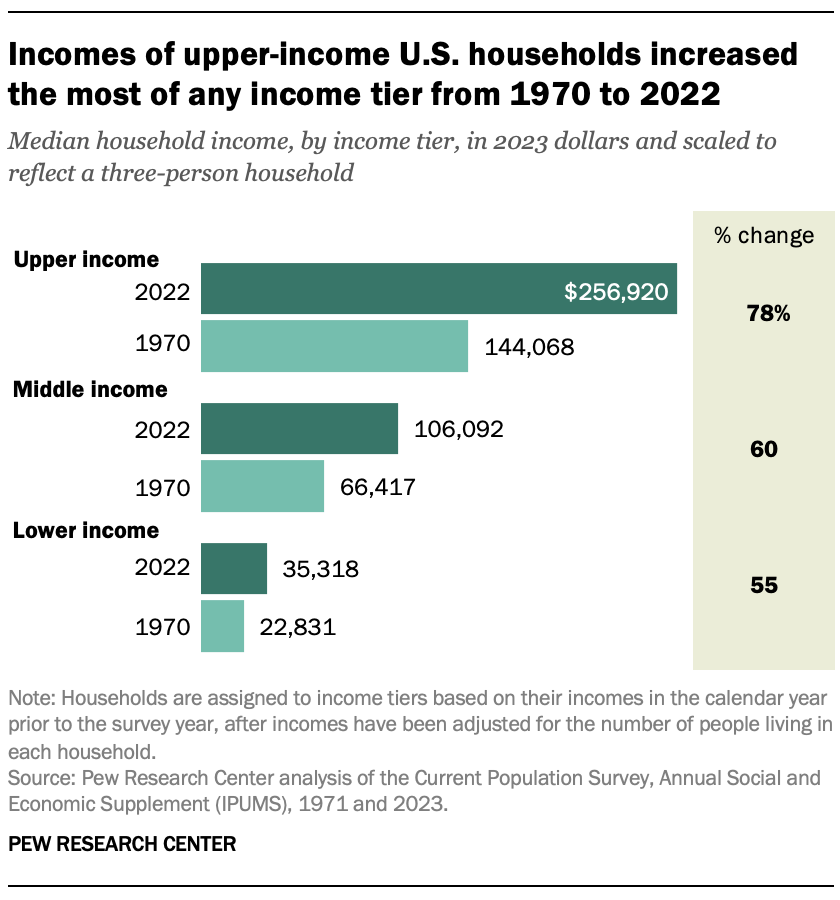

Aim For Six Figures

According to Pew Research, you need to make $106,092 to be middle class. Keep in mind that the data is from 2022.

You'll need to multiply that number by 30%, or roughly 10% a year for inflation, according to the Chapwood Index. The total over the last three years indicates that $140,000 a year is needed to be middle class in the United States in 2025.

Key Point: Budgeting, debt freedom, investing, homeownership, and higher income are the five pillars of real middle-class wealth.

Why This Matters: More Than Just Money

The real middle class isn’t about a salary number. The middle class has been the bedrock because it has had financial security and options.

Stress Free

No more panic when your car breaks down. You have an emergency fund to cover your medical emergencies.

Freedom To Change Jobs

You don't live paycheck to paycheck. You don't need to accept the first job offer. You have the freedom to upskill and transition to a better-paying job.

Retirement

You properly plan for your retirement. You're financially prepared by having more than one income stream. You aren't solely dependent upon Social Security or Medicare once you reach retirement age.

How You Can Start Today

Track Your Spending Habits

Start by tracking your spending for thirty days.

Monitor your spending on both your debit and credit cards.

Review your bank statements at the end of the week.

Pick Your Highest Debt

Choose your debt with the highest interest rate.

Focus on paying it off first using the debt avalanche method.

Brokerage Account

Open a brokerage account online.

Start small by investing $100 a month in an index fund.

Start to research individual stocks.

Open a Roth IRA account to fund your retirement.

Related

Summary: You Have To Work Harder To Be Middle Class Today

The old middle-class path, where you went to college, got a steady 9-to-5 job, and your job paid you a pension or retirement, is gone.

The new path to becoming middle class?

Smart money habits, investing, and income growth.

You can still achieve a middle-class lifestyle by properly managing your finances and investing in appreciating assets.

Key Point: True middle-class wealth is built by practicing positive financial habits and increasing your net worth.

Disclaimer: This content is for educational, entertainment, and informational purposes only. This is not business, financial, investment, or any advice. I write online about topics that interest me. I make mistakes just like everyone else. Always conduct your own research and consult a professional before making decisions regarding health, life, finances, investments, taxes, or legal matters.